- Malaysia

- /

- Energy Services

- /

- KLSE:OVH

Take Care Before Diving Into The Deep End On Ocean Vantage Holdings Berhad (KLSE:OVH)

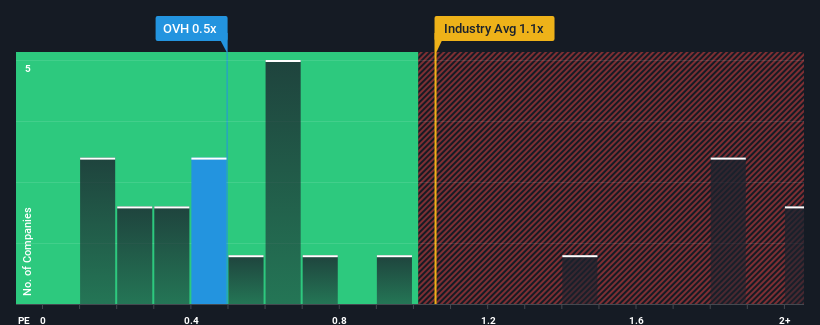

There wouldn't be many who think Ocean Vantage Holdings Berhad's (KLSE:OVH) price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S for the Energy Services industry in Malaysia is similar at about 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Ocean Vantage Holdings Berhad

What Does Ocean Vantage Holdings Berhad's P/S Mean For Shareholders?

Ocean Vantage Holdings Berhad has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Ocean Vantage Holdings Berhad's earnings, revenue and cash flow.How Is Ocean Vantage Holdings Berhad's Revenue Growth Trending?

Ocean Vantage Holdings Berhad's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.4% last year. This was backed up an excellent period prior to see revenue up by 130% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

In contrast to the company, the rest of the industry is expected to decline by 4.2% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's peculiar that Ocean Vantage Holdings Berhad's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Ocean Vantage Holdings Berhad revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. Without the guidance of analysts, perhaps shareholders are feeling uncertain over whether the revenue performance can continue amidst a declining industry outlook. The fact that the company's relative performance has not provided a kick to the share price suggests that some investors are anticipating revenue instability.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Ocean Vantage Holdings Berhad (1 can't be ignored) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:OVH

Ocean Vantage Holdings Berhad

An investment holding company, provides integrated support services for the upstream and downstream of the oil and gas industry in Malaysia and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success