- Malaysia

- /

- Energy Services

- /

- KLSE:OVH

Further Upside For Ocean Vantage Holdings Berhad (KLSE:OVH) Shares Could Introduce Price Risks After 28% Bounce

Ocean Vantage Holdings Berhad (KLSE:OVH) shareholders have had their patience rewarded with a 28% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 14% over that time.

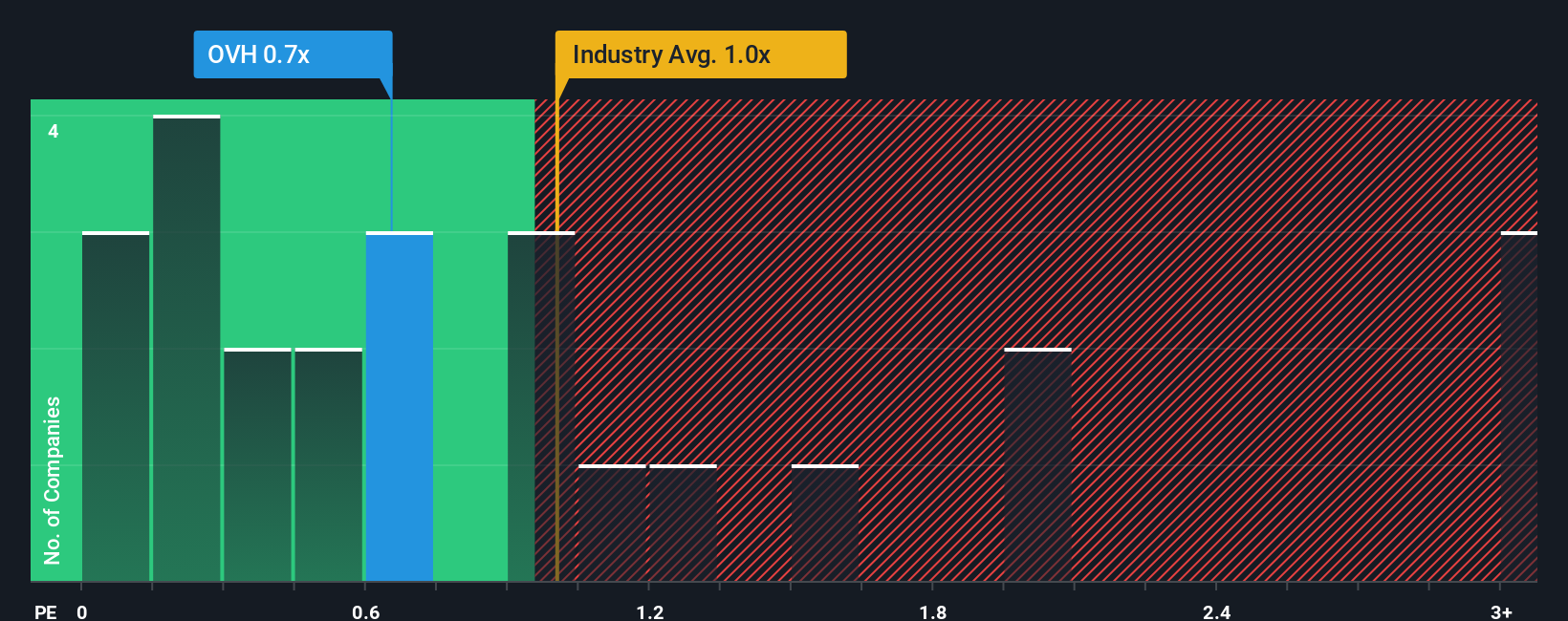

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Ocean Vantage Holdings Berhad's P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Energy Services industry in Malaysia is also close to 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Ocean Vantage Holdings Berhad

What Does Ocean Vantage Holdings Berhad's Recent Performance Look Like?

For example, consider that Ocean Vantage Holdings Berhad's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Ocean Vantage Holdings Berhad, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Ocean Vantage Holdings Berhad?

The only time you'd be comfortable seeing a P/S like Ocean Vantage Holdings Berhad's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 24% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 4.0% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to shrink 10% in the next 12 months, the company's downward momentum is still superior based on recent medium-term annualised revenue results.

In light of this, the fact Ocean Vantage Holdings Berhad's P/S sits in line with the majority of other companies is unanticipated but certainly not shocking. Even if the company's recent growth rates continue outperforming the industry, shrinking revenues are unlikely to lead to a stable P/S long-term. Even just maintaining these prices will be difficult to achieve as recent revenue trends are already weighing down the shares.

The Final Word

Ocean Vantage Holdings Berhad's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Even though revenue is has been declining, we've seen that Ocean Vantage Holdings Berhad's P/S remains higher than the industry, partially attributable to the fact that the industry's revenue outlook is set to decline even further. The fact that the company's P/S is on par with the industry despite the fact that it outperformed it could be an indication of some unobserved threats to future revenues. Perhaps there is some hesitation about the company's ability to deviate from the industry's dismal performance and maintain a relatively smaller revenue decline. While the chance of a downward share price shock is quite unlikely, there does seem to be something concerning shareholders as the relative performance would usually justify a higher price.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Ocean Vantage Holdings Berhad (2 don't sit too well with us!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:OVH

Ocean Vantage Holdings Berhad

An investment holding company, provides integrated support services for the upstream and downstream of the oil and gas industry in Malaysia and internationally.

Excellent balance sheet slight.

Market Insights

Community Narratives