- Malaysia

- /

- Energy Services

- /

- KLSE:MHB

Malaysia Marine and Heavy Engineering Holdings Berhad's (KLSE:MHB) Earnings Are Weaker Than They Seem

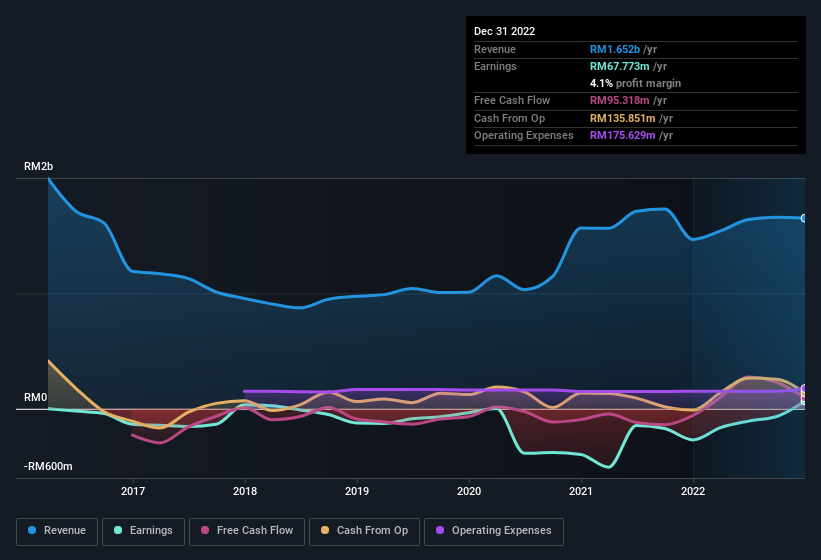

Despite announcing strong earnings, Malaysia Marine and Heavy Engineering Holdings Berhad's (KLSE:MHB) stock was sluggish. We did some digging and found some worrying underlying problems.

See our latest analysis for Malaysia Marine and Heavy Engineering Holdings Berhad

An Unusual Tax Situation

We can see that Malaysia Marine and Heavy Engineering Holdings Berhad received a tax benefit of RM21m. This is meaningful because companies usually pay tax rather than receive tax benefits. The receipt of a tax benefit is obviously a good thing, on its own. And given that it lost money last year, it seems possible that the benefit is evidence that it now expects to find value in its past tax losses. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Malaysia Marine and Heavy Engineering Holdings Berhad's Profit Performance

In its most recent report, Malaysia Marine and Heavy Engineering Holdings Berhad disclosed a tax benefit, as we discussed above. Tax is usually an expense, not a benefit, so we don't think the reported profit number is a particularly good guide to the earning potential of the business. As a result, we think it may well be the case that Malaysia Marine and Heavy Engineering Holdings Berhad's underlying earnings power is lower than its statutory profit. The good news is that it earned a profit in the last twelve months, despite its previous loss. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. For example - Malaysia Marine and Heavy Engineering Holdings Berhad has 1 warning sign we think you should be aware of.

Today we've zoomed in on a single data point to better understand the nature of Malaysia Marine and Heavy Engineering Holdings Berhad's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MHB

Malaysia Marine and Heavy Engineering Holdings Berhad

An investment holding company, provides marine and heavy engineering solutions for offshore and onshore facilities, and vessels in Malaysia.

Good value with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026