- Malaysia

- /

- Oil and Gas

- /

- KLSE:HHRG

HHRG Berhad (KLSE:HHRG) Held Back By Insufficient Growth Even After Shares Climb 30%

The HHRG Berhad (KLSE:HHRG) share price has done very well over the last month, posting an excellent gain of 30%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 30% in the last twelve months.

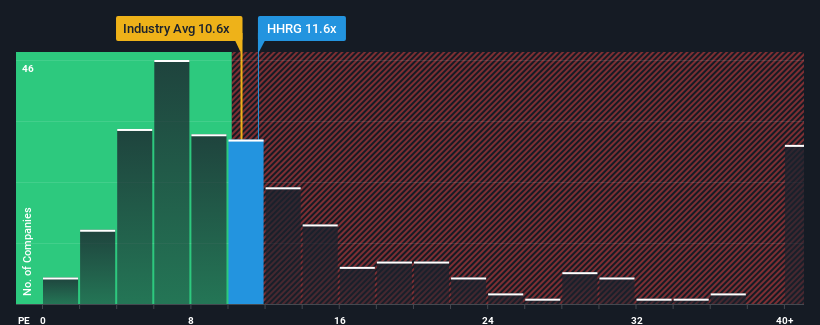

Even after such a large jump in price, given about half the companies in Malaysia have price-to-earnings ratios (or "P/E's") above 14x, you may still consider HHRG Berhad as an attractive investment with its 11.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Our free stock report includes 3 warning signs investors should be aware of before investing in HHRG Berhad. Read for free now.For example, consider that HHRG Berhad's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for HHRG Berhad

Is There Any Growth For HHRG Berhad?

HHRG Berhad's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 39%. As a result, earnings from three years ago have also fallen 29% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 16% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we are not surprised that HHRG Berhad is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On HHRG Berhad's P/E

HHRG Berhad's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of HHRG Berhad revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 3 warning signs for HHRG Berhad that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if HHRG Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HHRG

HHRG Berhad

An investment holding company, engages in the manufacture and trading of coconut biomass materials and value-added products in Malaysia, the United Kingdom, Japan, China, and internationally.

Flawless balance sheet low.

Market Insights

Community Narratives