- Malaysia

- /

- Oil and Gas

- /

- KLSE:ELRIDGE

Elridge Energy Holdings Berhad's (KLSE:ELRIDGE) Price In Tune With Revenues

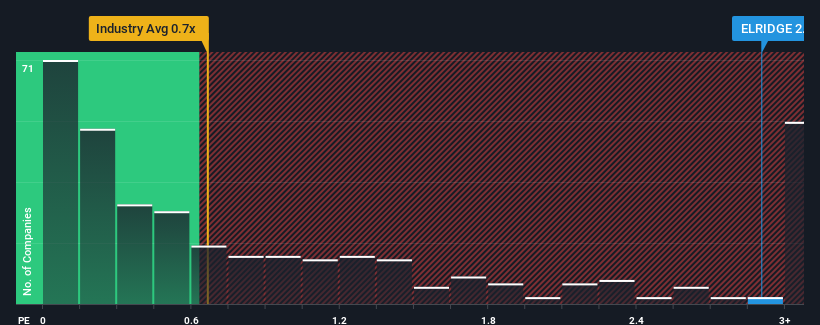

When you see that almost half of the companies in the Oil and Gas industry in Malaysia have price-to-sales ratios (or "P/S") below 0.5x, Elridge Energy Holdings Berhad (KLSE:ELRIDGE) looks to be giving off strong sell signals with its 2.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Our free stock report includes 1 warning sign investors should be aware of before investing in Elridge Energy Holdings Berhad. Read for free now.View our latest analysis for Elridge Energy Holdings Berhad

What Does Elridge Energy Holdings Berhad's Recent Performance Look Like?

The revenue growth achieved at Elridge Energy Holdings Berhad over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Elridge Energy Holdings Berhad's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Elridge Energy Holdings Berhad would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. The latest three year period has also seen an excellent 238% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to decline by 4.9% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this in mind, it's clear to us why Elridge Energy Holdings Berhad's P/S exceeds that of its industry peers. Investors are willing to pay more for a stock they hope will buck the trend of the broader industry going backwards. Nonetheless, with most other businesses facing an uphill battle, staying on its current revenue path is no certainty.

The Bottom Line On Elridge Energy Holdings Berhad's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As detailed previously, the strength of Elridge Energy Holdings Berhad's recent revenue trends over the medium-term relative to a declining industry is part of the reason why it trades at a higher P/S than its industry counterparts. Right now shareholders are comfortable with the P/S as they are quite confident revenues aren't under threat. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Although, if the company's relative performance doesn't change it will continue to provide strong support to the share price.

Having said that, be aware Elridge Energy Holdings Berhad is showing 1 warning sign in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Elridge Energy Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ELRIDGE

Elridge Energy Holdings Berhad

An investment holding company, engages in the manufacture and trading of biomass fuel products in Malaysia, Singapore, Indonesia, Japan, and Thailand.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives