- Malaysia

- /

- Energy Services

- /

- KLSE:DAYANG

Lacklustre Performance Is Driving Dayang Enterprise Holdings Bhd's (KLSE:DAYANG) 30% Price Drop

The Dayang Enterprise Holdings Bhd (KLSE:DAYANG) share price has fared very poorly over the last month, falling by a substantial 30%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 31% share price drop.

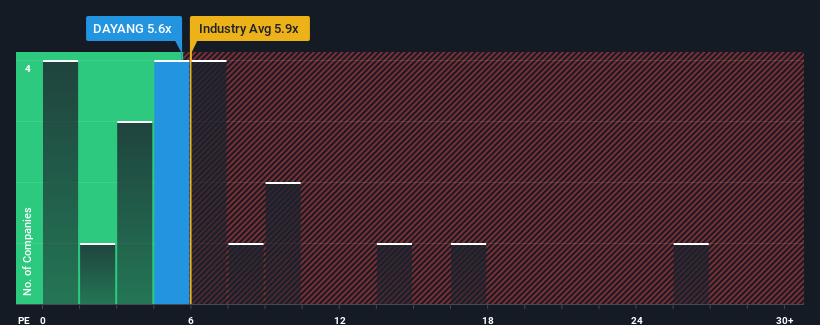

Even after such a large drop in price, Dayang Enterprise Holdings Bhd may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 5.6x, since almost half of all companies in Malaysia have P/E ratios greater than 15x and even P/E's higher than 24x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings growth that's superior to most other companies of late, Dayang Enterprise Holdings Bhd has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Dayang Enterprise Holdings Bhd

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Dayang Enterprise Holdings Bhd's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered an exceptional 42% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 3.8% over the next year. With the market predicted to deliver 16% growth , the company is positioned for a weaker earnings result.

With this information, we can see why Dayang Enterprise Holdings Bhd is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Shares in Dayang Enterprise Holdings Bhd have plummeted and its P/E is now low enough to touch the ground. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Dayang Enterprise Holdings Bhd maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Dayang Enterprise Holdings Bhd (of which 1 can't be ignored!) you should know about.

You might be able to find a better investment than Dayang Enterprise Holdings Bhd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:DAYANG

Dayang Enterprise Holdings Bhd

An investment holding company, provides offshore topside maintenance services, minor fabrication works, and offshore hook-up and commissioning services to the oil and gas companies in Malaysia.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives