- Malaysia

- /

- Energy Services

- /

- KLSE:CARIMIN

Here's Why We Think Carimin Petroleum Berhad (KLSE:CARIMIN) Is Well Worth Watching

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Carimin Petroleum Berhad (KLSE:CARIMIN). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Carimin Petroleum Berhad

How Fast Is Carimin Petroleum Berhad Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. As a tree reaches steadily for the sky, Carimin Petroleum Berhad's EPS has grown 18% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

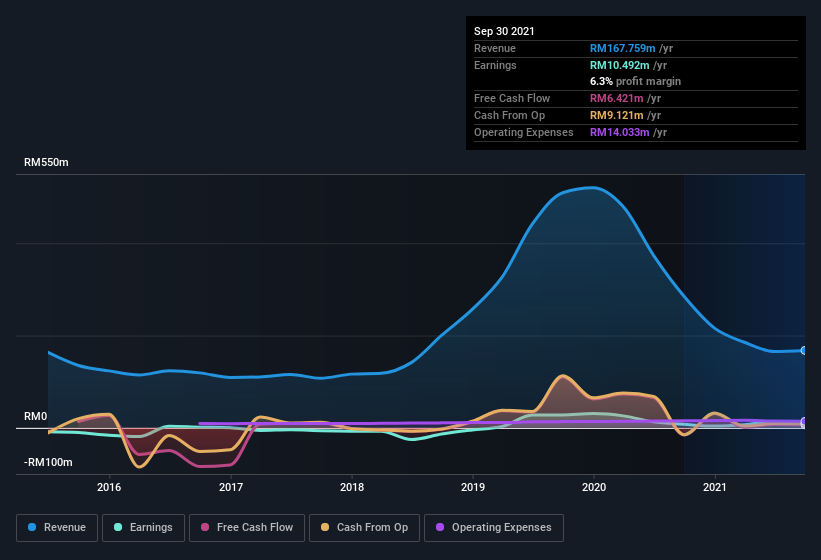

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Unfortunately, Carimin Petroleum Berhad's revenue dropped 41% last year, but the silver lining is that EBIT margins improved from 6.0% to 9.6%. That falls short of ideal.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Since Carimin Petroleum Berhad is no giant, with a market capitalization of RM156m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Carimin Petroleum Berhad Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that Carimin Petroleum Berhad insiders have a significant amount of capital invested in the stock. To be specific, they have RM52m worth of shares. That's a lot of money, and no small incentive to work hard. That amounts to 34% of the company, demonstrating a degree of high-level alignment with shareholders.

Should You Add Carimin Petroleum Berhad To Your Watchlist?

You can't deny that Carimin Petroleum Berhad has grown its earnings per share at a very impressive rate. That's attractive. Further, the high level of insider ownership impresses me, and suggests that I'm not the only one who appreciates the EPS growth. So this is very likely the kind of business that I like to spend time researching, with a view to discerning its true value. What about risks? Every company has them, and we've spotted 1 warning sign for Carimin Petroleum Berhad you should know about.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CARIMIN

Carimin Petroleum Berhad

An investment holding company, provides technical and engineering support services for upstream oil and gas companies in Malaysia.

Adequate balance sheet and overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026