- Malaysia

- /

- Energy Services

- /

- KLSE:BARAKAH

Barakah Offshore Petroleum Berhad's (KLSE:BARAKAH) Shares Leap 38% Yet They're Still Not Telling The Full Story

Those holding Barakah Offshore Petroleum Berhad (KLSE:BARAKAH) shares would be relieved that the share price has rebounded 38% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Looking back a bit further, it's encouraging to see the stock is up 57% in the last year.

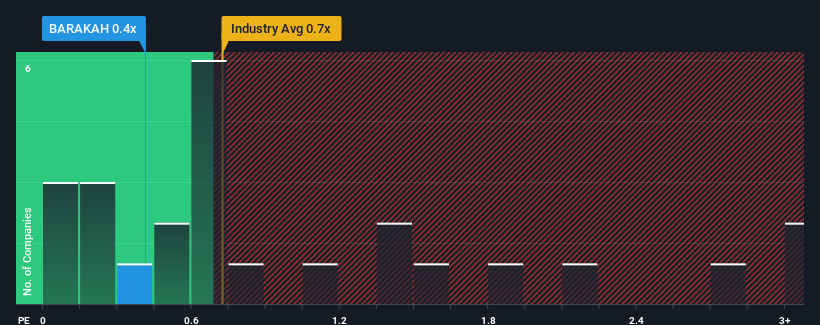

Although its price has surged higher, it's still not a stretch to say that Barakah Offshore Petroleum Berhad's price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Energy Services industry in Malaysia, where the median P/S ratio is around 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Barakah Offshore Petroleum Berhad

How Barakah Offshore Petroleum Berhad Has Been Performing

As an illustration, revenue has deteriorated at Barakah Offshore Petroleum Berhad over the last year, which is not ideal at all. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Barakah Offshore Petroleum Berhad will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Barakah Offshore Petroleum Berhad would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 1.8% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 27% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 13% shows it's a great look while it lasts.

With this information, we find it odd that Barakah Offshore Petroleum Berhad is trading at a fairly similar P/S to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What Does Barakah Offshore Petroleum Berhad's P/S Mean For Investors?

Barakah Offshore Petroleum Berhad appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Barakah Offshore Petroleum Berhad revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. Without the guidance of analysts, perhaps shareholders are feeling uncertain over whether the revenue performance can continue amidst a declining industry outlook. It appears some are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Barakah Offshore Petroleum Berhad (at least 1 which is significant), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Barakah Offshore Petroleum Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:BARAKAH

Barakah Offshore Petroleum Berhad

An investment holding company, engages in the provision of offshore and onshore services for oil and gas industry in Malaysia and Brunei Darussalam.

Flawless balance sheet and good value.

Market Insights

Community Narratives