- Malaysia

- /

- Energy Services

- /

- KLSE:BARAKAH

Barakah Offshore Petroleum Berhad (KLSE:BARAKAH) Stock Rockets 38% As Investors Are Less Pessimistic Than Expected

Barakah Offshore Petroleum Berhad (KLSE:BARAKAH) shareholders have had their patience rewarded with a 38% share price jump in the last month. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 8.3% over the last year.

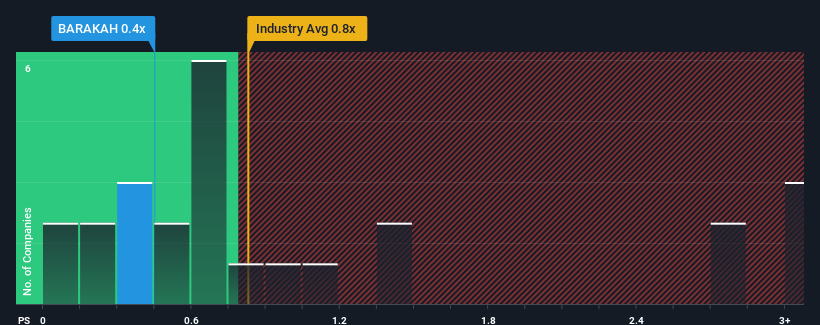

Although its price has surged higher, there still wouldn't be many who think Barakah Offshore Petroleum Berhad's price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in Malaysia's Energy Services industry is similar at about 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Barakah Offshore Petroleum Berhad

What Does Barakah Offshore Petroleum Berhad's Recent Performance Look Like?

As an illustration, revenue has deteriorated at Barakah Offshore Petroleum Berhad over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Barakah Offshore Petroleum Berhad will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Barakah Offshore Petroleum Berhad's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 23% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to shrink 5.4% in the next 12 months, the company's downward momentum is still inferior based on recent medium-term annualised revenue results.

In light of this, it's somewhat peculiar that Barakah Offshore Petroleum Berhad's P/S sits in line with the majority of other companies. In general, when revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Bottom Line On Barakah Offshore Petroleum Berhad's P/S

Barakah Offshore Petroleum Berhad's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Barakah Offshore Petroleum Berhad currently trades on a higher than expected P/S since its recent three-year revenues are even worse than the forecasts for a struggling industry. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. In addition, we would be concerned whether the company can even maintain its medium-term level of performance under these tough industry conditions. Unless the company's relative performance improves, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 4 warning signs for Barakah Offshore Petroleum Berhad (3 are potentially serious!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Barakah Offshore Petroleum Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Barakah Offshore Petroleum Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:BARAKAH

Barakah Offshore Petroleum Berhad

An investment holding company, engages in the provision of offshore and onshore services for oil and gas industry in Malaysia and Brunei Darussalam.

Flawless balance sheet and good value.

Market Insights

Community Narratives