- Malaysia

- /

- Energy Services

- /

- KLSE:BARAKAH

Barakah Offshore Petroleum Berhad (KLSE:BARAKAH) Might Not Be As Mispriced As It Looks After Plunging 29%

The Barakah Offshore Petroleum Berhad (KLSE:BARAKAH) share price has softened a substantial 29% over the previous 30 days, handing back much of the gains the stock has made lately. Longer-term shareholders would now have taken a real hit with the stock declining 9.1% in the last year.

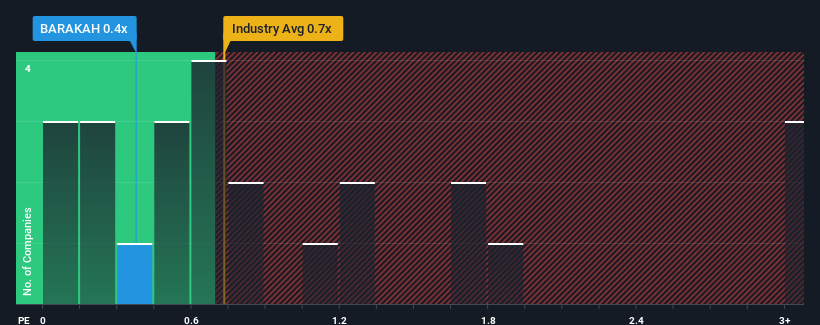

Although its price has dipped substantially, it's still not a stretch to say that Barakah Offshore Petroleum Berhad's price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Energy Services industry in Malaysia, where the median P/S ratio is around 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Barakah Offshore Petroleum Berhad

How Has Barakah Offshore Petroleum Berhad Performed Recently?

As an illustration, revenue has deteriorated at Barakah Offshore Petroleum Berhad over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Barakah Offshore Petroleum Berhad will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Barakah Offshore Petroleum Berhad's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 1.8% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 27% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 12% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

In light of this, it's peculiar that Barakah Offshore Petroleum Berhad's P/S sits in line with the majority of other companies. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Final Word

Barakah Offshore Petroleum Berhad's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As mentioned previously, Barakah Offshore Petroleum Berhad currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. Without the guidance of analysts, perhaps shareholders are feeling uncertain over whether the revenue performance can continue amidst a declining industry outlook. It appears some are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

It is also worth noting that we have found 3 warning signs for Barakah Offshore Petroleum Berhad (2 are significant!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Barakah Offshore Petroleum Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:BARAKAH

Barakah Offshore Petroleum Berhad

An investment holding company, engages in the provision of offshore and onshore services for oil and gas industry in Malaysia and Brunei Darussalam.

Flawless balance sheet and good value.

Market Insights

Community Narratives