- Malaysia

- /

- Energy Services

- /

- KLSE:ARMADA

Introducing Bumi Armada Berhad (KLSE:ARMADA), The Stock That Zoomed 203% In The Last Year

Unfortunately, investing is risky - companies can and do go bankrupt. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Bumi Armada Berhad (KLSE:ARMADA) share price had more than doubled in just one year - up 203%. On top of that, the share price is up 19% in about a quarter. Zooming out, the stock is actually down 18% in the last three years.

View our latest analysis for Bumi Armada Berhad

Bumi Armada Berhad isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Bumi Armada Berhad saw its revenue shrink by 15%. So we would not have expected the share price to rise 203%. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. Of course, it could be that the market expected this revenue drop.

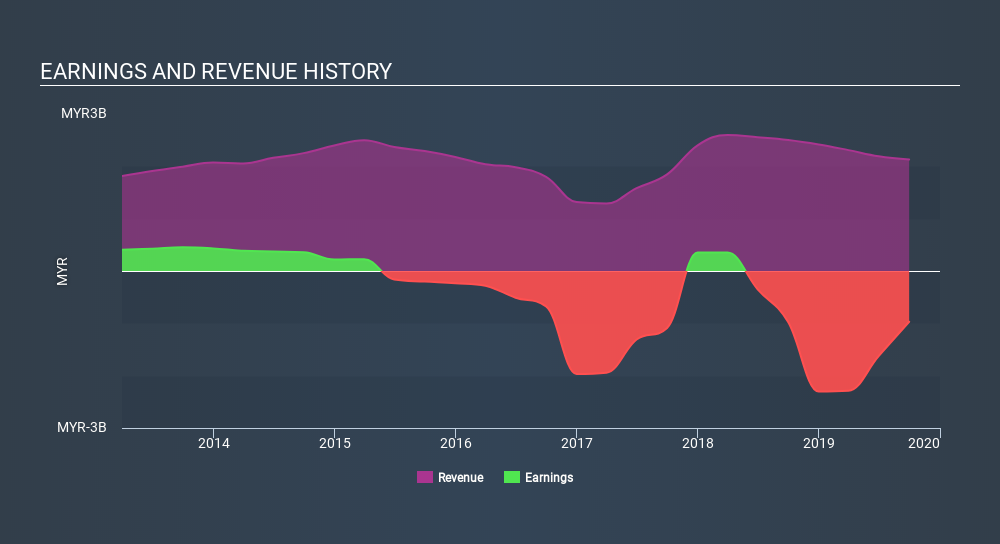

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free report showing analyst forecasts should help you form a view on Bumi Armada Berhad

A Different Perspective

It's nice to see that Bumi Armada Berhad shareholders have received a total shareholder return of 203% over the last year. That certainly beats the loss of about 16% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Bumi Armada Berhad that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KLSE:ARMADA

Bumi Armada Berhad

An investment holding company, engages in providing marine transportation, floating production storage offloading (FPSO) operations, and engineering and maintenance services to offshore oil and gas companies.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives