- Malaysia

- /

- Energy Services

- /

- KLSE:ARMADA

Further Upside For Bumi Armada Berhad (KLSE:ARMADA) Shares Could Introduce Price Risks After 31% Bounce

Bumi Armada Berhad (KLSE:ARMADA) shareholders have had their patience rewarded with a 31% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 37% in the last year.

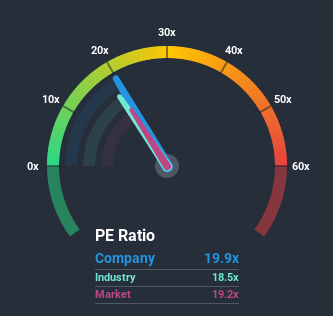

In spite of the firm bounce in price, there still wouldn't be many who think Bumi Armada Berhad's price-to-earnings (or "P/E") ratio of 19.9x is worth a mention when the median P/E in Malaysia is similar at about 19x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been pleasing for Bumi Armada Berhad as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Bumi Armada Berhad

How Is Bumi Armada Berhad's Growth Trending?

The only time you'd be comfortable seeing a P/E like Bumi Armada Berhad's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 126%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 64% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 53% per year during the coming three years according to the analysts following the company. With the market only predicted to deliver 14% per year, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Bumi Armada Berhad is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Bumi Armada Berhad's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Bumi Armada Berhad currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Bumi Armada Berhad (1 doesn't sit too well with us) you should be aware of.

If these risks are making you reconsider your opinion on Bumi Armada Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

When trading Bumi Armada Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Bumi Armada Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bumi Armada Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:ARMADA

Bumi Armada Berhad

An investment holding company, engages in providing marine transportation, floating production storage offloading (FPSO) operations, and engineering and maintenance services to offshore oil and gas companies.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives