- Malaysia

- /

- Energy Services

- /

- KLSE:ARMADA

Does Bumi Armada Berhad (KLSE:ARMADA) Have A Healthy Balance Sheet?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Bumi Armada Berhad (KLSE:ARMADA) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Bumi Armada Berhad

What Is Bumi Armada Berhad's Net Debt?

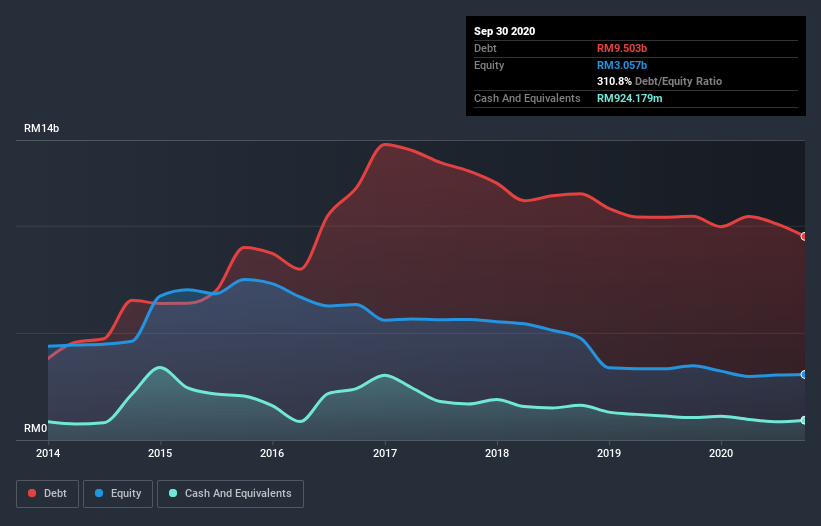

You can click the graphic below for the historical numbers, but it shows that Bumi Armada Berhad had RM9.50b of debt in September 2020, down from RM10.4b, one year before. On the flip side, it has RM924.2m in cash leading to net debt of about RM8.58b.

How Healthy Is Bumi Armada Berhad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Bumi Armada Berhad had liabilities of RM2.29b due within 12 months and liabilities of RM7.93b due beyond that. Offsetting this, it had RM924.2m in cash and RM949.4m in receivables that were due within 12 months. So it has liabilities totalling RM8.34b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the RM2.24b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Bumi Armada Berhad would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Weak interest cover of 1.6 times and a disturbingly high net debt to EBITDA ratio of 6.4 hit our confidence in Bumi Armada Berhad like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. Looking on the bright side, Bumi Armada Berhad boosted its EBIT by a silky 51% in the last year. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Bumi Armada Berhad's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Happily for any shareholders, Bumi Armada Berhad actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

While Bumi Armada Berhad's level of total liabilities has us nervous. To wit both its conversion of EBIT to free cash flow and EBIT growth rate were encouraging signs. When we consider all the factors discussed, it seems to us that Bumi Armada Berhad is taking some risks with its use of debt. While that debt can boost returns, we think the company has enough leverage now. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 1 warning sign we've spotted with Bumi Armada Berhad .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade Bumi Armada Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bumi Armada Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:ARMADA

Bumi Armada Berhad

An investment holding company, engages in providing marine transportation, floating production storage offloading (FPSO) operations, and engineering and maintenance services to offshore oil and gas companies.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives