- Malaysia

- /

- Energy Services

- /

- KLSE:ALAM

Take Care Before Jumping Onto Alam Maritim Resources Berhad (KLSE:ALAM) Even Though It's 29% Cheaper

Alam Maritim Resources Berhad (KLSE:ALAM) shares have had a horrible month, losing 29% after a relatively good period beforehand. Longer-term, the stock has been solid despite a difficult 30 days, gaining 25% in the last year.

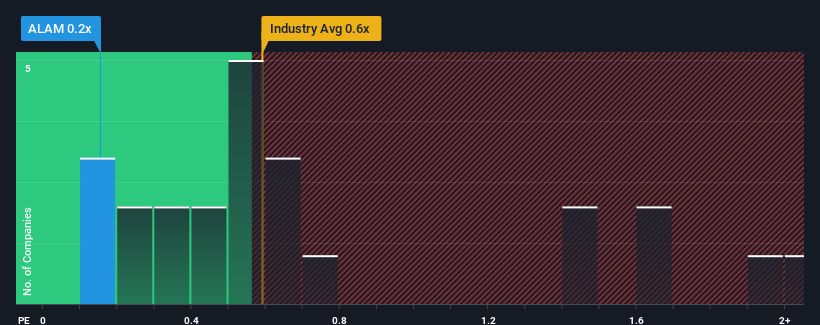

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Alam Maritim Resources Berhad's P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Energy Services industry in Malaysia is also close to 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Alam Maritim Resources Berhad

What Does Alam Maritim Resources Berhad's Recent Performance Look Like?

The revenue growth achieved at Alam Maritim Resources Berhad over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Alam Maritim Resources Berhad will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

Alam Maritim Resources Berhad's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 9.3% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 12% overall drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to decline by 6.4% over the next year, even worse than the company's recent medium-term annualised revenue decline.

In light of this, the fact Alam Maritim Resources Berhad's P/S sits in line with the majority of other companies is unanticipated but certainly not shocking. There's no guarantee the P/S has found a floor yet with recent revenue going backwards, despite the industry heading down even harder. Even just maintaining these prices will be difficult to achieve as recent revenue trends are already weighing down the shares.

The Bottom Line On Alam Maritim Resources Berhad's P/S

Following Alam Maritim Resources Berhad's share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Alam Maritim Resources Berhad currently trades on a slightly lower than expected P/S if you consider its recent three-year revenues aren't as bad as the forecasts for a struggling industry. The fact that the company's P/S is on par with the industry despite the fact that it outperformed it could be an indication of some unobserved threats to future revenues. Perhaps investors have reservations about the company's ability to sustain this level of performance amidst the challenging industry conditions. While the chance of a downward share price shock is quite unlikely, there does seem to be something concerning shareholders as the relative performance would usually justify a higher price.

You should always think about risks. Case in point, we've spotted 5 warning signs for Alam Maritim Resources Berhad you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ALAM

Alam Maritim Resources Berhad

An investment holding company, provides services to the oil and gas industry in Malaysia.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.