- Malaysia

- /

- Diversified Financial

- /

- KLSE:RTECH

RichTech Digital Berhad's (KLSE:RTECH) Low P/E No Reason For Excitement

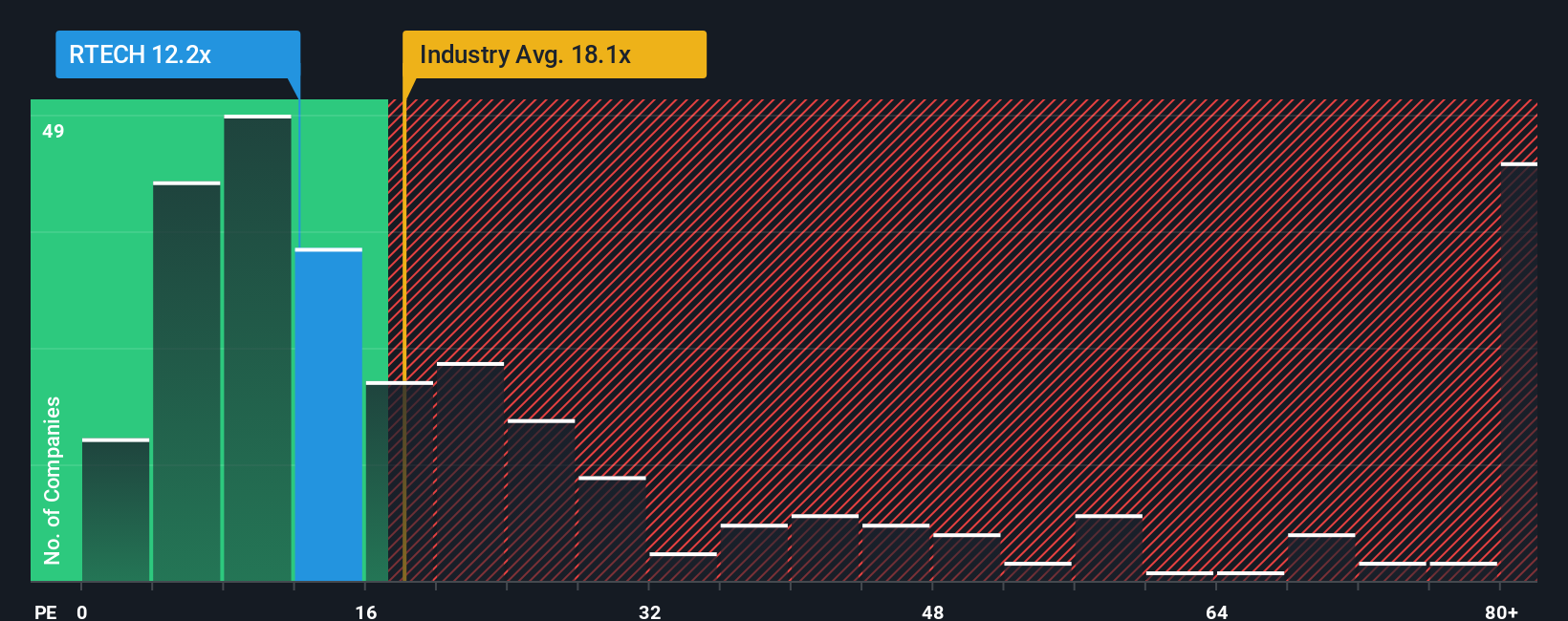

RichTech Digital Berhad's (KLSE:RTECH) price-to-earnings (or "P/E") ratio of 12.2x might make it look like a buy right now compared to the market in Malaysia, where around half of the companies have P/E ratios above 15x and even P/E's above 26x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For instance, RichTech Digital Berhad's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for RichTech Digital Berhad

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as RichTech Digital Berhad's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 38% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 15% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 16% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's understandable that RichTech Digital Berhad's P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Bottom Line On RichTech Digital Berhad's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that RichTech Digital Berhad maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for RichTech Digital Berhad that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:RTECH

RichTech Digital Berhad

Provides electronic reloads and bill payment services in Malaysia.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026