- Malaysia

- /

- Hospitality

- /

- KLSE:SHANG

Further weakness as Shangri-La Hotels (Malaysia) Berhad (KLSE:SHANG) drops 11% this week, taking five-year losses to 63%

We think intelligent long term investing is the way to go. But unfortunately, some companies simply don't succeed. For example, after five long years the Shangri-La Hotels (Malaysia) Berhad (KLSE:SHANG) share price is a whole 65% lower. That's not a lot of fun for true believers. And some of the more recent buyers are probably worried, too, with the stock falling 41% in the last year. And the share price decline continued over the last week, dropping some 11%.

If the past week is anything to go by, investor sentiment for Shangri-La Hotels (Malaysia) Berhad isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Shangri-La Hotels (Malaysia) Berhad

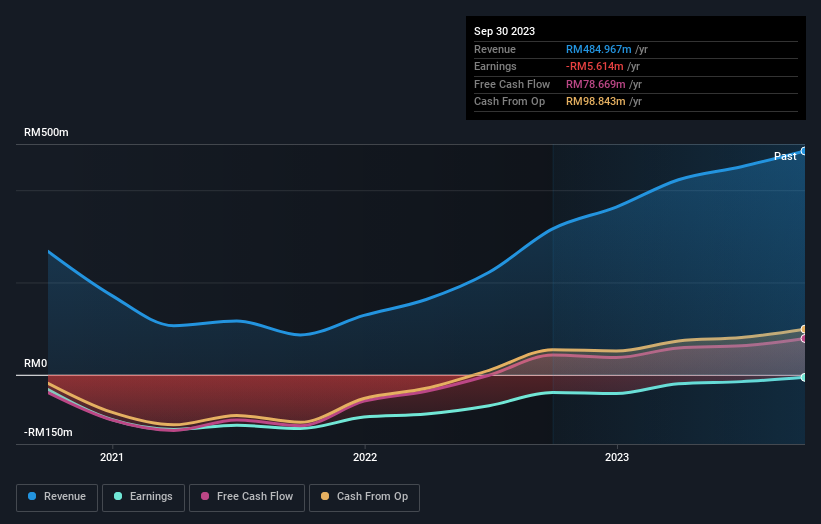

Given that Shangri-La Hotels (Malaysia) Berhad didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last five years Shangri-La Hotels (Malaysia) Berhad saw its revenue shrink by 13% per year. That puts it in an unattractive cohort, to put it mildly. Arguably, the market has responded appropriately to this business performance by sending the share price down 10% (annualized) in the same time period. We don't generally like to own companies that lose money and don't grow revenues. You might be better off spending your money on a leisure activity. This looks like a really risky stock to buy, at a glance.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Shangri-La Hotels (Malaysia) Berhad's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Shangri-La Hotels (Malaysia) Berhad's TSR, which was a 63% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

Investors in Shangri-La Hotels (Malaysia) Berhad had a tough year, with a total loss of 41%, against a market gain of about 8.4%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Shangri-La Hotels (Malaysia) Berhad is showing 1 warning sign in our investment analysis , you should know about...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SHANG

Shangri-La Hotels (Malaysia) Berhad

An investment holding company, engages in the operation of hotels and beach resorts primarily in Malaysia.

Adequate balance sheet with acceptable track record.