- Malaysia

- /

- Consumer Services

- /

- KLSE:CYBERE

Here's Why We Think Minda Global Berhad (KLSE:MINDA) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Minda Global Berhad (KLSE:MINDA). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Minda Global Berhad with the means to add long-term value to shareholders.

See our latest analysis for Minda Global Berhad

How Fast Is Minda Global Berhad Growing Its Earnings Per Share?

Minda Global Berhad has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. Minda Global Berhad's EPS skyrocketed from RM0.0028 to RM0.0039, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 39%.

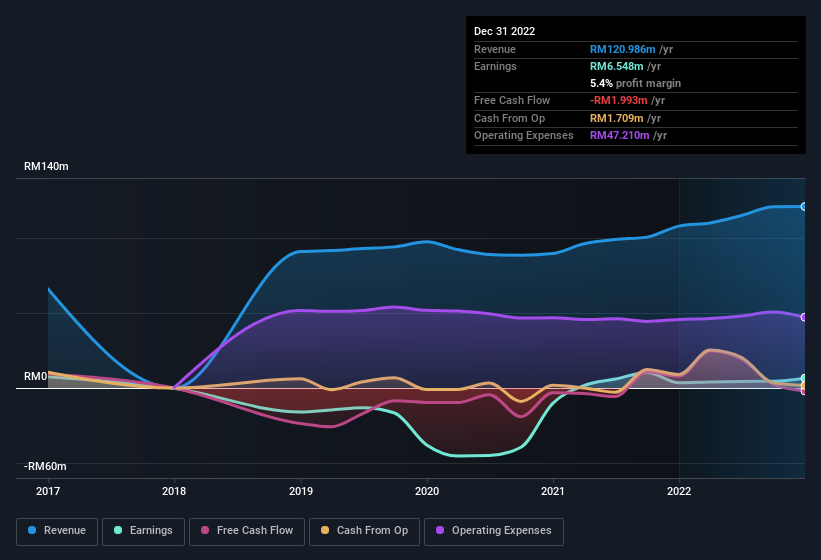

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. On the revenue front, Minda Global Berhad has done well over the past year, growing revenue by 12% to RM121m but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Minda Global Berhad isn't a huge company, given its market capitalisation of RM235m. That makes it extra important to check on its balance sheet strength.

Are Minda Global Berhad Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalisations under RM884m, like Minda Global Berhad, the median CEO pay is around RM479k.

Minda Global Berhad's CEO only received compensation totalling RM8.0k in the year to December 2021. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Minda Global Berhad To Your Watchlist?

You can't deny that Minda Global Berhad has grown its earnings per share at a very impressive rate. That's attractive. The fast growth bodes well while the very reasonable CEO pay assists builds some confidence in the board. We think that based on its merits alone, this stock is worth watching into the future. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Minda Global Berhad (1 is a bit concerning) you should be aware of.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CYBERE

Cyberjaya Education Group Berhad

An investment holding company, provides educational and training services in Malaysia.

Proven track record with low risk.

Market Insights

Community Narratives