- Malaysia

- /

- Hospitality

- /

- KLSE:MBRIGHT

The Compensation For Meta Bright Group Berhad's (KLSE:MBRIGHT) CEO Looks Deserved And Here's Why

Key Insights

- Meta Bright Group Berhad's Annual General Meeting to take place on 15th of December

- Total pay for CEO Chee Lee includes RM420.0k salary

- The overall pay is comparable to the industry average

- Meta Bright Group Berhad's EPS grew by 100% over the past three years while total shareholder return over the past three years was 77%

The performance at Meta Bright Group Berhad (KLSE:MBRIGHT) has been quite strong recently and CEO Chee Lee has played a role in it. Coming up to the next AGM on 15th of December, shareholders would be keeping this in mind. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. Here is our take on why we think CEO compensation is not extravagant.

See our latest analysis for Meta Bright Group Berhad

Comparing Meta Bright Group Berhad's CEO Compensation With The Industry

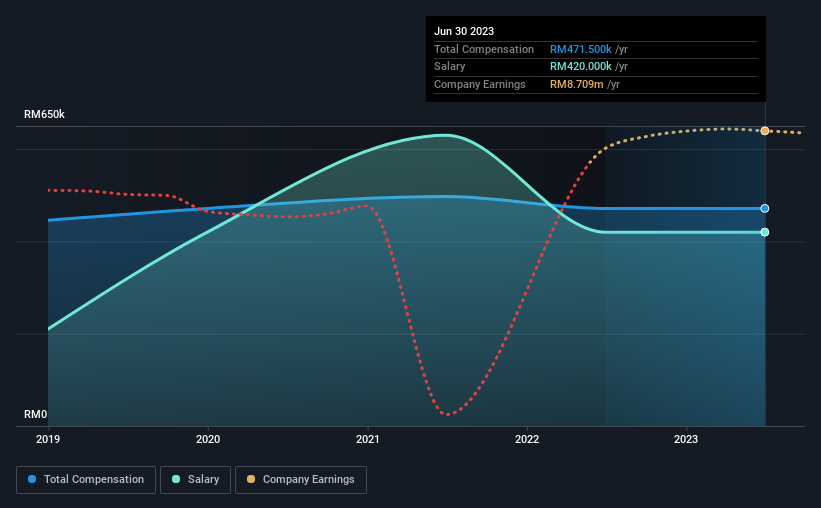

Our data indicates that Meta Bright Group Berhad has a market capitalization of RM443m, and total annual CEO compensation was reported as RM472k for the year to June 2023. That is, the compensation was roughly the same as last year. In particular, the salary of RM420.0k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the Malaysian Hospitality industry with market capitalizations below RM933m, reported a median total CEO compensation of RM431k. This suggests that Meta Bright Group Berhad remunerates its CEO largely in line with the industry average. What's more, Chee Lee holds RM17m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | RM420k | RM420k | 89% |

| Other | RM52k | RM51k | 11% |

| Total Compensation | RM472k | RM471k | 100% |

Speaking on an industry level, nearly 77% of total compensation represents salary, while the remainder of 23% is other remuneration. Meta Bright Group Berhad pays out 89% of remuneration in the form of a salary, significantly higher than the industry average. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Meta Bright Group Berhad's Growth

Meta Bright Group Berhad's earnings per share (EPS) grew 100% per year over the last three years. Its revenue is up 18% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Meta Bright Group Berhad Been A Good Investment?

We think that the total shareholder return of 77%, over three years, would leave most Meta Bright Group Berhad shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 3 warning signs for Meta Bright Group Berhad that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MBRIGHT

Meta Bright Group Berhad

An investment holding company, engages in the property development and investment, and hotel operations businesses primarily in Malaysia and Australia.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives