- Malaysia

- /

- Hospitality

- /

- KLSE:FOCUS

Slammed 50% Focus Dynamics Group Berhad (KLSE:FOCUS) Screens Well Here But There Might Be A Catch

Focus Dynamics Group Berhad (KLSE:FOCUS) shareholders that were waiting for something to happen have been dealt a blow with a 50% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 60% share price decline.

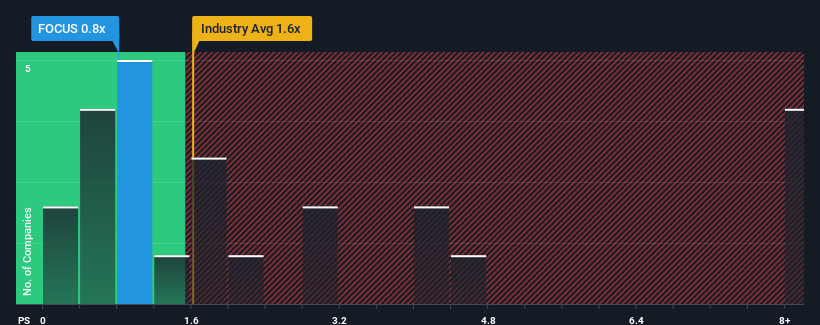

Following the heavy fall in price, Focus Dynamics Group Berhad may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.8x, since almost half of all companies in the Hospitality industry in Malaysia have P/S ratios greater than 1.6x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Focus Dynamics Group Berhad

What Does Focus Dynamics Group Berhad's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Focus Dynamics Group Berhad has been doing very well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Focus Dynamics Group Berhad will help you shine a light on its historical performance.How Is Focus Dynamics Group Berhad's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Focus Dynamics Group Berhad's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 145% gain to the company's top line. Pleasingly, revenue has also lifted 49% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 4.7% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Focus Dynamics Group Berhad is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Focus Dynamics Group Berhad's P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We're very surprised to see Focus Dynamics Group Berhad currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Focus Dynamics Group Berhad you should be aware of, and 2 of them can't be ignored.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:FOCUS

Focus Dynamics Group Berhad

An investment holding company, primarily engages in operation and management of food and beverage outlet business in Malaysia and Hong Kong.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026