- Malaysia

- /

- Hospitality

- /

- KLSE:FOCUS

Not Many Are Piling Into Focus Dynamics Group Berhad (KLSE:FOCUS) Stock Yet As It Plummets 50%

Unfortunately for some shareholders, the Focus Dynamics Group Berhad (KLSE:FOCUS) share price has dived 50% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 50% share price decline.

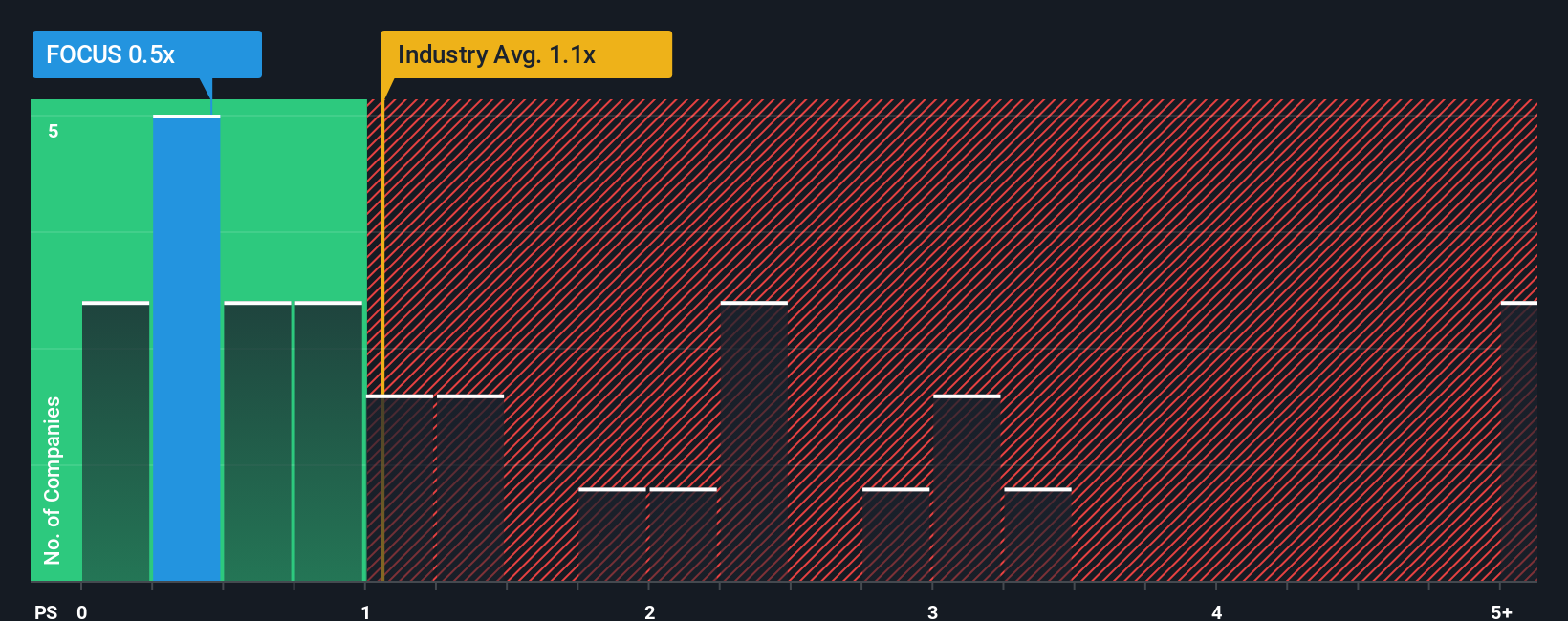

After such a large drop in price, considering around half the companies operating in Malaysia's Hospitality industry have price-to-sales ratios (or "P/S") above 1.1x, you may consider Focus Dynamics Group Berhad as an solid investment opportunity with its 0.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Focus Dynamics Group Berhad

How Focus Dynamics Group Berhad Has Been Performing

For instance, Focus Dynamics Group Berhad's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Focus Dynamics Group Berhad will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Focus Dynamics Group Berhad will help you shine a light on its historical performance.How Is Focus Dynamics Group Berhad's Revenue Growth Trending?

In order to justify its P/S ratio, Focus Dynamics Group Berhad would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 24% decrease to the company's top line. Even so, admirably revenue has lifted 115% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 13%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's peculiar that Focus Dynamics Group Berhad's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What Does Focus Dynamics Group Berhad's P/S Mean For Investors?

Focus Dynamics Group Berhad's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Focus Dynamics Group Berhad currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Focus Dynamics Group Berhad that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:FOCUS

Focus Dynamics Group Berhad

An investment holding company, primarily engages in operation and management of food and beverage outlet business in Malaysia and Hong Kong.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026