- Malaysia

- /

- Hospitality

- /

- KLSE:BJFOOD

Subdued Growth No Barrier To Berjaya Food Berhad (KLSE:BJFOOD) With Shares Advancing 27%

Berjaya Food Berhad (KLSE:BJFOOD) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 22% over that time.

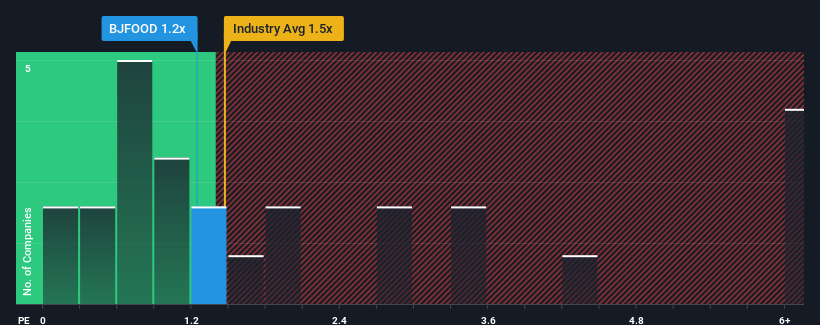

Although its price has surged higher, there still wouldn't be many who think Berjaya Food Berhad's price-to-sales (or "P/S") ratio of 1.2x is worth a mention when the median P/S in Malaysia's Hospitality industry is similar at about 1.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Berjaya Food Berhad

How Has Berjaya Food Berhad Performed Recently?

While the industry has experienced revenue growth lately, Berjaya Food Berhad's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Berjaya Food Berhad's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Berjaya Food Berhad would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 10%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 60% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 1.6% over the next year. That's shaping up to be materially lower than the 4.5% growth forecast for the broader industry.

With this in mind, we find it intriguing that Berjaya Food Berhad's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

Berjaya Food Berhad's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given that Berjaya Food Berhad's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 3 warning signs for Berjaya Food Berhad (1 is a bit unpleasant!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Berjaya Food Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:BJFOOD

Berjaya Food Berhad

An investment holding company, develops and operates restaurants, café chains, and retail outlets in Malaysia and other Southeast Asian countries.

Good value with concerning outlook.

Market Insights

Community Narratives