- Malaysia

- /

- Food and Staples Retail

- /

- KLSE:KTC

We Think Kim Teck Cheong Consolidated Berhad (KLSE:KTC) Is Taking Some Risk With Its Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Kim Teck Cheong Consolidated Berhad (KLSE:KTC) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Kim Teck Cheong Consolidated Berhad

How Much Debt Does Kim Teck Cheong Consolidated Berhad Carry?

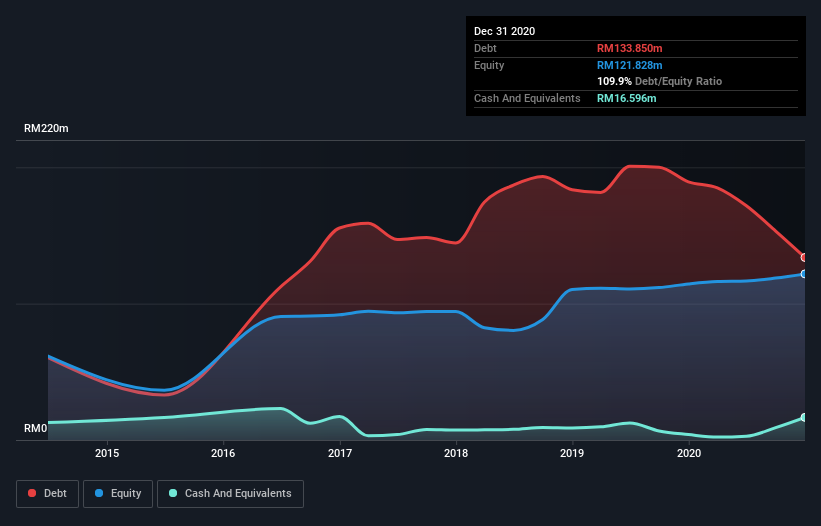

You can click the graphic below for the historical numbers, but it shows that Kim Teck Cheong Consolidated Berhad had RM133.9m of debt in December 2020, down from RM189.3m, one year before. However, it also had RM16.6m in cash, and so its net debt is RM117.3m.

How Healthy Is Kim Teck Cheong Consolidated Berhad's Balance Sheet?

The latest balance sheet data shows that Kim Teck Cheong Consolidated Berhad had liabilities of RM170.1m due within a year, and liabilities of RM32.7m falling due after that. Offsetting this, it had RM16.6m in cash and RM104.6m in receivables that were due within 12 months. So its liabilities total RM81.7m more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of RM103.9m, so it does suggest shareholders should keep an eye on Kim Teck Cheong Consolidated Berhad's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Kim Teck Cheong Consolidated Berhad shareholders face the double whammy of a high net debt to EBITDA ratio (5.4), and fairly weak interest coverage, since EBIT is just 2.4 times the interest expense. This means we'd consider it to have a heavy debt load. Another concern for investors might be that Kim Teck Cheong Consolidated Berhad's EBIT fell 11% in the last year. If that's the way things keep going handling the debt load will be like delivering hot coffees on a pogo stick. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Kim Teck Cheong Consolidated Berhad will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the most recent three years, Kim Teck Cheong Consolidated Berhad recorded free cash flow worth 65% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

To be frank both Kim Teck Cheong Consolidated Berhad's interest cover and its track record of managing its debt, based on its EBITDA, make us rather uncomfortable with its debt levels. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Kim Teck Cheong Consolidated Berhad stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 4 warning signs we've spotted with Kim Teck Cheong Consolidated Berhad (including 1 which shouldn't be ignored) .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kim Teck Cheong Consolidated Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:KTC

Kim Teck Cheong Consolidated Berhad

Engages in distribution and warehousing of consumer packaged goods in East Malaysia and Brunei.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026