- Malaysia

- /

- Food and Staples Retail

- /

- KLSE:KTC

Here's Why Kim Teck Cheong Consolidated Berhad (KLSE:KTC) Can Manage Its Debt Responsibly

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Kim Teck Cheong Consolidated Berhad (KLSE:KTC) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Kim Teck Cheong Consolidated Berhad

How Much Debt Does Kim Teck Cheong Consolidated Berhad Carry?

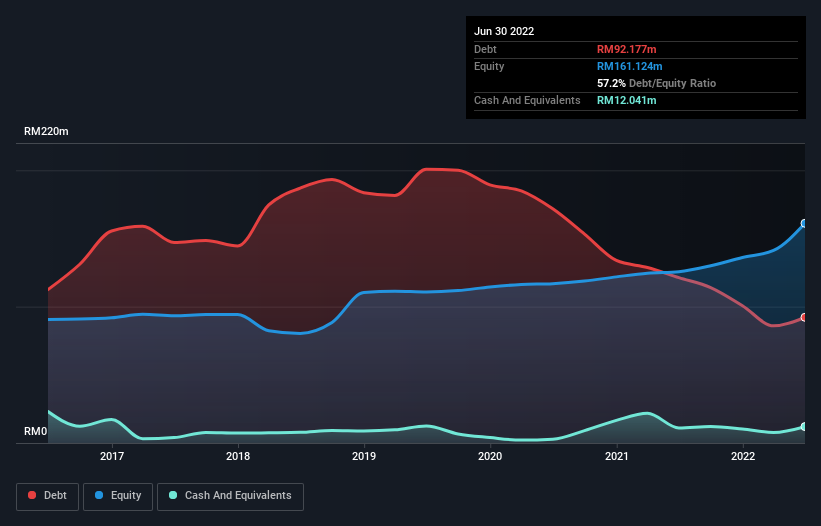

As you can see below, Kim Teck Cheong Consolidated Berhad had RM92.2m of debt at June 2022, down from RM121.3m a year prior. On the flip side, it has RM12.0m in cash leading to net debt of about RM80.1m.

How Strong Is Kim Teck Cheong Consolidated Berhad's Balance Sheet?

We can see from the most recent balance sheet that Kim Teck Cheong Consolidated Berhad had liabilities of RM127.1m falling due within a year, and liabilities of RM36.4m due beyond that. Offsetting this, it had RM12.0m in cash and RM113.6m in receivables that were due within 12 months. So it has liabilities totalling RM37.8m more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since Kim Teck Cheong Consolidated Berhad has a market capitalization of RM139.8m, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With a debt to EBITDA ratio of 2.1, Kim Teck Cheong Consolidated Berhad uses debt artfully but responsibly. And the alluring interest cover (EBIT of 9.3 times interest expense) certainly does not do anything to dispel this impression. It is well worth noting that Kim Teck Cheong Consolidated Berhad's EBIT shot up like bamboo after rain, gaining 84% in the last twelve months. That'll make it easier to manage its debt. There's no doubt that we learn most about debt from the balance sheet. But it is Kim Teck Cheong Consolidated Berhad's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Kim Teck Cheong Consolidated Berhad actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

The good news is that Kim Teck Cheong Consolidated Berhad's demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. And that's just the beginning of the good news since its EBIT growth rate is also very heartening. Looking at the bigger picture, we think Kim Teck Cheong Consolidated Berhad's use of debt seems quite reasonable and we're not concerned about it. After all, sensible leverage can boost returns on equity. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - Kim Teck Cheong Consolidated Berhad has 3 warning signs we think you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Kim Teck Cheong Consolidated Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KTC

Kim Teck Cheong Consolidated Berhad

Engages in distribution and warehousing of consumer packaged goods in East Malaysia and Brunei.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026