XiDeLang Holdings Ltd's (KLSE:XDL) Share Price Could Signal Some Risk

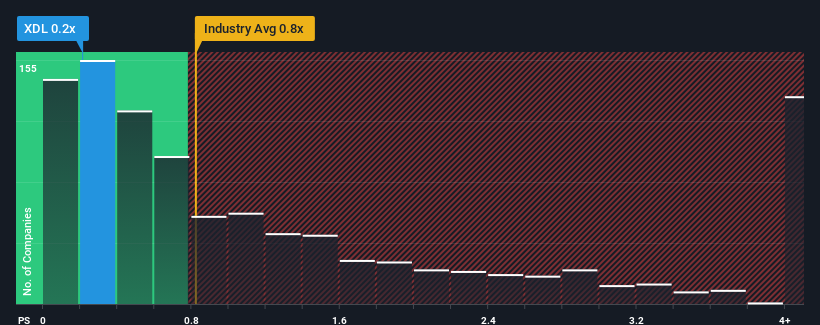

With a median price-to-sales (or "P/S") ratio of close to 0.7x in the Luxury industry in Malaysia, you could be forgiven for feeling indifferent about XiDeLang Holdings Ltd's (KLSE:XDL) P/S ratio of 0.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for XiDeLang Holdings

How XiDeLang Holdings Has Been Performing

It looks like revenue growth has deserted XiDeLang Holdings recently, which is not something to boast about. Perhaps the market believes the recent run-of-the-mill revenue performance isn't enough to outperform the industry, which has kept the P/S muted. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

Although there are no analyst estimates available for XiDeLang Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For XiDeLang Holdings?

The only time you'd be comfortable seeing a P/S like XiDeLang Holdings' is when the company's growth is tracking the industry closely.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period was better as it's delivered a decent 22% overall rise in revenue. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 13% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that XiDeLang Holdings' P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does XiDeLang Holdings' P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that XiDeLang Holdings' average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

Having said that, be aware XiDeLang Holdings is showing 3 warning signs in our investment analysis, and 2 of those are significant.

If these risks are making you reconsider your opinion on XiDeLang Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:XDL

XiDeLang Holdings

An investment holding company, designs, manufactures, and markets sports shoes primarily in the Peoples’ Republic of China.

Adequate balance sheet with low risk.

Market Insights

Community Narratives