- Malaysia

- /

- Consumer Durables

- /

- KLSE:MILUX

Milux Corporation Berhad's (KLSE:MILUX) Robust Profit May Be Overstating Its True Earnings Potential

Following the release of a positive earnings report recently, Milux Corporation Berhad's (KLSE:MILUX) stock performed well. However, we think that investors should be cautious when interpreting the profit numbers.

Check out the opportunities and risks within the MY Consumer Durables industry.

Zooming In On Milux Corporation Berhad's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

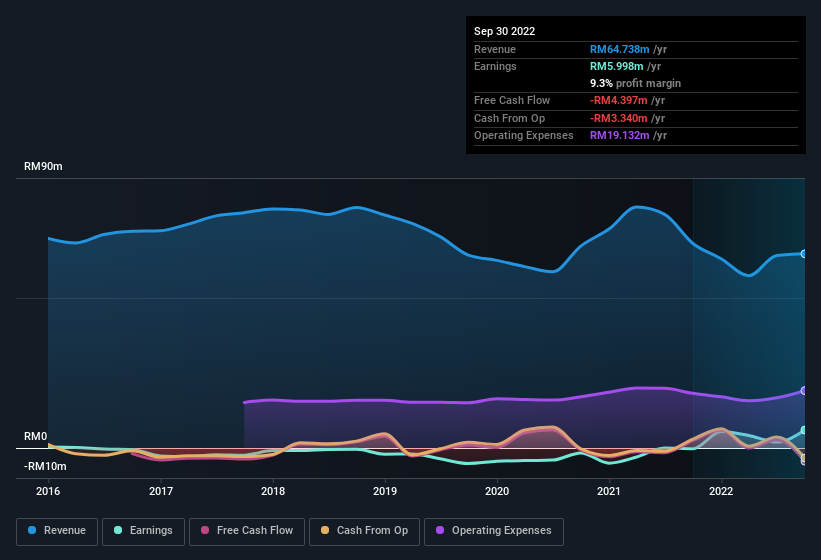

For the year to September 2022, Milux Corporation Berhad had an accrual ratio of 0.32. Therefore, we know that it's free cashflow was significantly lower than its statutory profit, raising questions about how useful that profit figure really is. In the last twelve months it actually had negative free cash flow, with an outflow of RM4.4m despite its profit of RM6.00m, mentioned above. We saw that FCF was RM2.5m a year ago though, so Milux Corporation Berhad has at least been able to generate positive FCF in the past. However, that's not all there is to consider. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio. One positive for Milux Corporation Berhad shareholders is that it's accrual ratio was significantly better last year, providing reason to believe that it may return to stronger cash conversion in the future. Shareholders should look for improved cashflow relative to profit in the current year, if that is indeed the case.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Milux Corporation Berhad.

The Impact Of Unusual Items On Profit

The fact that the company had unusual items boosting profit by RM8.5m, in the last year, probably goes some way to explain why its accrual ratio was so weak. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's as you'd expect, given these boosts are described as 'unusual'. Milux Corporation Berhad had a rather significant contribution from unusual items relative to its profit to September 2022. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On Milux Corporation Berhad's Profit Performance

Summing up, Milux Corporation Berhad received a nice boost to profit from unusual items, but could not match its paper profit with free cash flow. For the reasons mentioned above, we think that a perfunctory glance at Milux Corporation Berhad's statutory profits might make it look better than it really is on an underlying level. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. When we did our research, we found 2 warning signs for Milux Corporation Berhad (1 is significant!) that we believe deserve your full attention.

Our examination of Milux Corporation Berhad has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MILUX

Milux Corporation Berhad

An investment holding company, provides a range of gas, kitchen, and electrical appliances in Malaysia and rest of Asia.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026