- Malaysia

- /

- Consumer Durables

- /

- KLSE:LEESK

Investors Still Aren't Entirely Convinced By Lee Swee Kiat Group Berhad's (KLSE:LEESK) Earnings Despite 41% Price Jump

Lee Swee Kiat Group Berhad (KLSE:LEESK) shareholders have had their patience rewarded with a 41% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 35%.

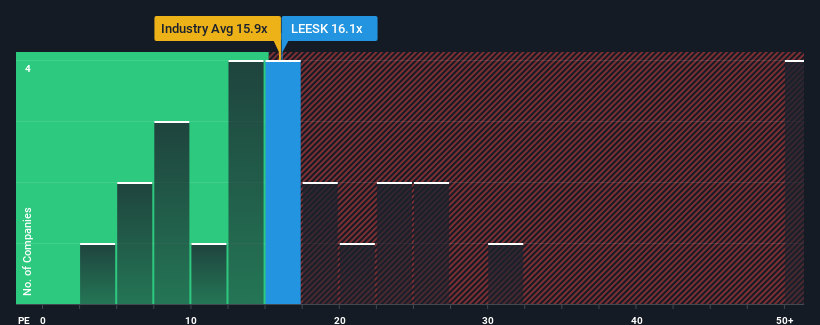

In spite of the firm bounce in price, it's still not a stretch to say that Lee Swee Kiat Group Berhad's price-to-earnings (or "P/E") ratio of 16.1x right now seems quite "middle-of-the-road" compared to the market in Malaysia, where the median P/E ratio is around 16x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Lee Swee Kiat Group Berhad certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Lee Swee Kiat Group Berhad

How Is Lee Swee Kiat Group Berhad's Growth Trending?

Lee Swee Kiat Group Berhad's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a decent 2.9% gain to the company's bottom line. This was backed up an excellent period prior to see EPS up by 38% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 39% as estimated by the three analysts watching the company. With the market only predicted to deliver 16%, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Lee Swee Kiat Group Berhad is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Lee Swee Kiat Group Berhad appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Lee Swee Kiat Group Berhad currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 2 warning signs for Lee Swee Kiat Group Berhad that we have uncovered.

Of course, you might also be able to find a better stock than Lee Swee Kiat Group Berhad. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:LEESK

Lee Swee Kiat Group Berhad

An investment holding company, engages in manufacturing, retail, trading, and distribution of mattresses and bedding accessories primarily in Malaysia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success