- Malaysia

- /

- Consumer Durables

- /

- KLSE:FPI

Formosa Prosonic Industries Berhad (KLSE:FPI) Has Announced That It Will Be Increasing Its Dividend To RM0.20

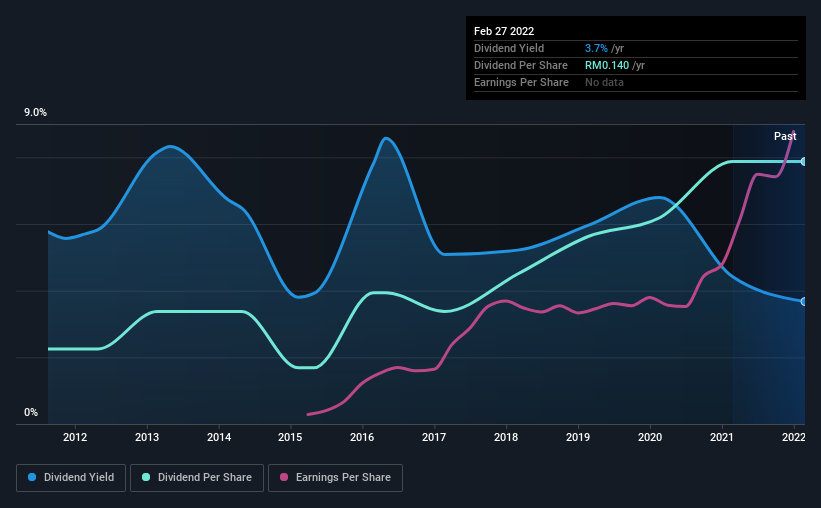

Formosa Prosonic Industries Berhad (KLSE:FPI) will increase its dividend on the 28th of April to RM0.20, which is 43% higher than last year. This takes the dividend yield from 3.7% to 5.2%, which shareholders will be pleased with.

View our latest analysis for Formosa Prosonic Industries Berhad

Formosa Prosonic Industries Berhad's Earnings Easily Cover the Distributions

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Based on the last payment, Formosa Prosonic Industries Berhad was paying only paying out a fraction of earnings, but the payment was a massive 407% of cash flows. While the business may be attempting to set a balanced dividend policy, a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

Over the next year, EPS could expand by 39.3% if recent trends continue. If the dividend continues on this path, the payout ratio could be 45% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. The first annual payment during the last 10 years was RM0.04 in 2012, and the most recent fiscal year payment was RM0.14. This means that it has been growing its distributions at 13% per annum over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. We are encouraged to see that Formosa Prosonic Industries Berhad has grown earnings per share at 39% per year over the past five years. Earnings per share is growing at a solid clip, and the payout ratio is low which we think is an ideal combination in a dividend stock as the company can quite easily raise the dividend in the future.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. While the low payout ratio is redeeming feature, this is offset by the minimal cash to cover the payments. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 3 warning signs for Formosa Prosonic Industries Berhad (of which 1 is significant!) you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:FPI

Formosa Prosonic Industries Berhad

Manufactures and sells speaker system products in Malaysia.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success