- Malaysia

- /

- Commercial Services

- /

- KLSE:HHHCORP

We Think Hiap Huat Holdings Berhad (KLSE:HHHCORP) Can Stay On Top Of Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Hiap Huat Holdings Berhad (KLSE:HHHCORP) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Hiap Huat Holdings Berhad

How Much Debt Does Hiap Huat Holdings Berhad Carry?

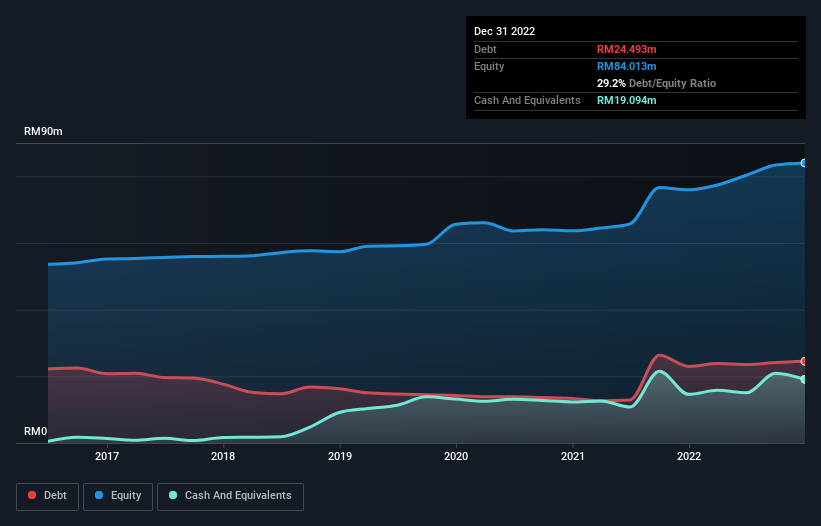

The image below, which you can click on for greater detail, shows that at December 2022 Hiap Huat Holdings Berhad had debt of RM24.5m, up from RM23.0m in one year. However, it also had RM19.1m in cash, and so its net debt is RM5.40m.

How Strong Is Hiap Huat Holdings Berhad's Balance Sheet?

According to the last reported balance sheet, Hiap Huat Holdings Berhad had liabilities of RM7.56m due within 12 months, and liabilities of RM32.8m due beyond 12 months. On the other hand, it had cash of RM19.1m and RM13.2m worth of receivables due within a year. So its liabilities total RM8.10m more than the combination of its cash and short-term receivables.

Of course, Hiap Huat Holdings Berhad has a market capitalization of RM57.3m, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Hiap Huat Holdings Berhad has a low net debt to EBITDA ratio of only 0.33. And its EBIT covers its interest expense a whopping 12.0 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. In addition to that, we're happy to report that Hiap Huat Holdings Berhad has boosted its EBIT by 70%, thus reducing the spectre of future debt repayments. When analysing debt levels, the balance sheet is the obvious place to start. But it is Hiap Huat Holdings Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last two years, Hiap Huat Holdings Berhad reported free cash flow worth 16% of its EBIT, which is really quite low. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

Hiap Huat Holdings Berhad's EBIT growth rate suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But, on a more sombre note, we are a little concerned by its conversion of EBIT to free cash flow. When we consider the range of factors above, it looks like Hiap Huat Holdings Berhad is pretty sensible with its use of debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Hiap Huat Holdings Berhad is showing 2 warning signs in our investment analysis , you should know about...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Hiap Huat Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HHHCORP

Hiap Huat Holdings Berhad

An investment holding company, manufactures, recycles, refines, and sells petroleum-based products, industrial paints, oils, solvent chemical products, and other related products in Malaysia, Singapore, Vietnam, and Italy.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives