- Malaysia

- /

- Commercial Services

- /

- KLSE:EURO

Take Care Before Jumping Onto Euro Holdings Berhad (KLSE:EURO) Even Though It's 29% Cheaper

Unfortunately for some shareholders, the Euro Holdings Berhad (KLSE:EURO) share price has dived 29% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 50% share price decline.

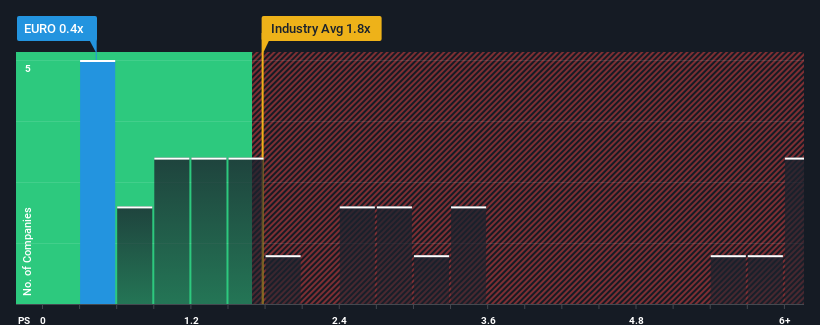

After such a large drop in price, Euro Holdings Berhad's price-to-sales (or "P/S") ratio of 0.4x might make it look like a buy right now compared to the Commercial Services industry in Malaysia, where around half of the companies have P/S ratios above 1.8x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Euro Holdings Berhad

What Does Euro Holdings Berhad's P/S Mean For Shareholders?

For example, consider that Euro Holdings Berhad's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Euro Holdings Berhad will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Euro Holdings Berhad will help you shine a light on its historical performance.How Is Euro Holdings Berhad's Revenue Growth Trending?

In order to justify its P/S ratio, Euro Holdings Berhad would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.2%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 223% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 30% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Euro Holdings Berhad is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does Euro Holdings Berhad's P/S Mean For Investors?

Euro Holdings Berhad's recently weak share price has pulled its P/S back below other Commercial Services companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We're very surprised to see Euro Holdings Berhad currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You need to take note of risks, for example - Euro Holdings Berhad has 5 warning signs (and 2 which shouldn't be ignored) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Euro Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:EURO

Euro Holdings Berhad

An investment holding company, engages in the manufacture, marketing, and trading of furniture.

Excellent balance sheet and good value.

Market Insights

Community Narratives