- Malaysia

- /

- Commercial Services

- /

- KLSE:EURO

Euro Holdings Berhad (KLSE:EURO) Is Carrying A Fair Bit Of Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Euro Holdings Berhad (KLSE:EURO) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Euro Holdings Berhad

How Much Debt Does Euro Holdings Berhad Carry?

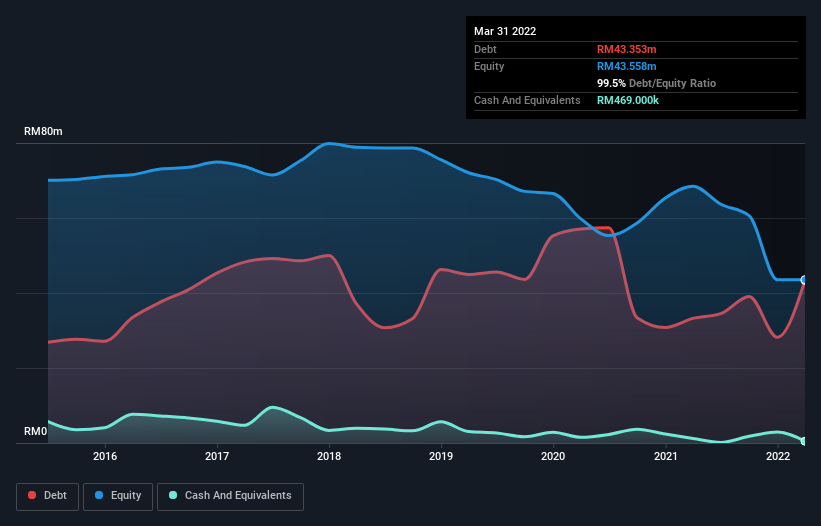

As you can see below, at the end of March 2022, Euro Holdings Berhad had RM43.4m of debt, up from RM33.2m a year ago. Click the image for more detail. Net debt is about the same, since the it doesn't have much cash.

How Healthy Is Euro Holdings Berhad's Balance Sheet?

We can see from the most recent balance sheet that Euro Holdings Berhad had liabilities of RM59.5m falling due within a year, and liabilities of RM7.77m due beyond that. Offsetting this, it had RM469.0k in cash and RM23.6m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM43.2m.

While this might seem like a lot, it is not so bad since Euro Holdings Berhad has a market capitalization of RM104.2m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. When analysing debt levels, the balance sheet is the obvious place to start. But it is Euro Holdings Berhad's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Euro Holdings Berhad wasn't profitable at an EBIT level, but managed to grow its revenue by 73%, to RM122m. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

While we can certainly appreciate Euro Holdings Berhad's revenue growth, its earnings before interest and tax (EBIT) loss is not ideal. Indeed, it lost a very considerable RM20m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. Another cause for caution is that is bled RM13m in negative free cash flow over the last twelve months. So in short it's a really risky stock. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 4 warning signs for Euro Holdings Berhad (of which 2 are a bit concerning!) you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you're looking to trade Euro Holdings Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Euro Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:EURO

Euro Holdings Berhad

An investment holding company, engages in the manufacture, marketing, and trading of furniture.

Excellent balance sheet and good value.

Market Insights

Community Narratives