YLI Holdings Berhad (KLSE:YLI) Use Of Debt Could Be Considered Risky

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies YLI Holdings Berhad (KLSE:YLI) makes use of debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for YLI Holdings Berhad

What Is YLI Holdings Berhad's Net Debt?

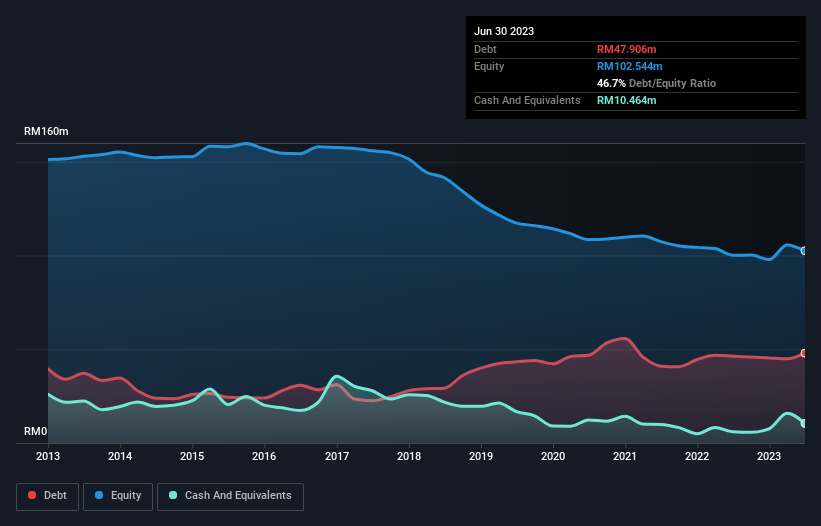

As you can see below, YLI Holdings Berhad had RM47.9m of debt, at June 2023, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of RM10.5m, its net debt is less, at about RM37.4m.

A Look At YLI Holdings Berhad's Liabilities

According to the last reported balance sheet, YLI Holdings Berhad had liabilities of RM79.7m due within 12 months, and liabilities of RM959.0k due beyond 12 months. Offsetting these obligations, it had cash of RM10.5m as well as receivables valued at RM21.9m due within 12 months. So it has liabilities totalling RM48.3m more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's market capitalization of RM32.9m, we think shareholders really should watch YLI Holdings Berhad's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

YLI Holdings Berhad's debt is 4.4 times its EBITDA, and its EBIT cover its interest expense 2.7 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. However, the silver lining was that YLI Holdings Berhad achieved a positive EBIT of RM6.2m in the last twelve months, an improvement on the prior year's loss. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since YLI Holdings Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Over the last year, YLI Holdings Berhad saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

On the face of it, YLI Holdings Berhad's level of total liabilities left us tentative about the stock, and its conversion of EBIT to free cash flow was no more enticing than the one empty restaurant on the busiest night of the year. But at least its EBIT growth rate is not so bad. After considering the datapoints discussed, we think YLI Holdings Berhad has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for YLI Holdings Berhad (1 is concerning!) that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:YLI

YLI Holdings Berhad

An investment holding company, manufactures, trades in, and sells ductile iron pipes, plastic pipes fittings, and waterwork related products in Malaysia, Singapore, and Vietnam.

Adequate balance sheet with low risk.

Market Insights

Community Narratives