Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So on that note, YLI Holdings Berhad (KLSE:YLI) looks quite promising in regards to its trends of return on capital.

What is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for YLI Holdings Berhad:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

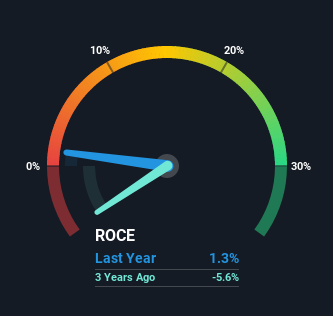

0.013 = RM1.4m ÷ (RM195m - RM84m) (Based on the trailing twelve months to March 2021).

Therefore, YLI Holdings Berhad has an ROCE of 1.3%. In absolute terms, that's a low return and it also under-performs the Building industry average of 5.6%.

See our latest analysis for YLI Holdings Berhad

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating YLI Holdings Berhad's past further, check out this free graph of past earnings, revenue and cash flow.

How Are Returns Trending?

We're delighted to see that YLI Holdings Berhad is reaping rewards from its investments and has now broken into profitability. While the business is profitable now, it used to be incurring losses on invested capital five years ago. In regards to capital employed, YLI Holdings Berhad is using 31% less capital than it was five years ago, which on the surface, can indicate that the business has become more efficient at generating these returns. This could potentially mean that the company is selling some of its assets.

For the record though, there was a noticeable increase in the company's current liabilities over the period, so we would attribute some of the ROCE growth to that. The current liabilities has increased to 43% of total assets, so the business is now more funded by the likes of its suppliers or short-term creditors. Given it's pretty high ratio, we'd remind investors that having current liabilities at those levels can bring about some risks in certain businesses.

What We Can Learn From YLI Holdings Berhad's ROCE

From what we've seen above, YLI Holdings Berhad has managed to increase it's returns on capital all the while reducing it's capital base. And since the stock has fallen 35% over the last five years, there might be an opportunity here. With that in mind, we believe the promising trends warrant this stock for further investigation.

One more thing, we've spotted 2 warning signs facing YLI Holdings Berhad that you might find interesting.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:YLI

YLI Holdings Berhad

An investment holding company, manufactures and trades in ductile iron pipes, steel and plastic pipes and fittings, and waterworks related products for the sewerage and waterworks industries in Malaysia, Singapore, and Vietnam.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives