Wong Engineering Corporation Berhad's (KLSE:WONG) CEO Will Probably Find It Hard To See A Huge Raise This Year

The underwhelming share price performance of Wong Engineering Corporation Berhad (KLSE:WONG) in the past three years would have disappointed many shareholders. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. In light of this performance, shareholders will have a chance to question the board in the upcoming AGM on 25 March 2021, where they can impact on future company performance by voting on resolutions, including executive compensation. We think shareholders may be cautious of approving a pay rise for the CEO at the moment, based on our analysis below.

See our latest analysis for Wong Engineering Corporation Berhad

Comparing Wong Engineering Corporation Berhad's CEO Compensation With the industry

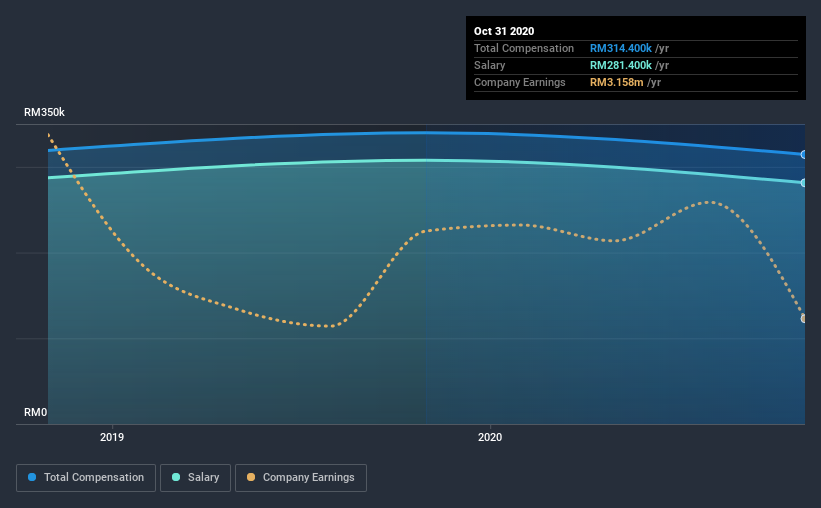

Our data indicates that Wong Engineering Corporation Berhad has a market capitalization of RM77m, and total annual CEO compensation was reported as RM314k for the year to October 2020. That's slightly lower by 7.5% over the previous year. Notably, the salary which is RM281.4k, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under RM826m, the reported median total CEO compensation was RM353k. From this we gather that Loy Yong is paid around the median for CEOs in the industry. Furthermore, Loy Yong directly owns RM15m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | RM281k | RM308k | 90% |

| Other | RM33k | RM32k | 10% |

| Total Compensation | RM314k | RM340k | 100% |

On an industry level, roughly 70% of total compensation represents salary and 30% is other remuneration. Wong Engineering Corporation Berhad is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Wong Engineering Corporation Berhad's Growth

Wong Engineering Corporation Berhad has reduced its earnings per share by 19% a year over the last three years. It achieved revenue growth of 16% over the last year.

The decrease in EPS could be a concern for some investors. On the other hand, the strong revenue growth suggests the business is growing. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Wong Engineering Corporation Berhad Been A Good Investment?

Since shareholders would have lost about 17% over three years, some Wong Engineering Corporation Berhad investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

The company's earnings haven't grown and possibly because of that, the stock has performed poorly, resulting in a loss for the company's shareholders. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 3 warning signs for Wong Engineering Corporation Berhad that investors should look into moving forward.

Important note: Wong Engineering Corporation Berhad is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Wong Engineering Corporation Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wong Engineering Corporation Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:WONG

Wong Engineering Corporation Berhad

Designs, manufactures, and sells high precision stamped and turned metal parts, components, and welded frame structures in Malaysia, Asia, Europe, and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives