Shareholders Will Most Likely Find Wong Engineering Corporation Berhad's (KLSE:WONG) CEO Compensation Acceptable

Under the guidance of CEO Loy Yong, Wong Engineering Corporation Berhad (KLSE:WONG) has performed reasonably well recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 24 March 2022. We present our case of why we think CEO compensation looks fair.

Check out our latest analysis for Wong Engineering Corporation Berhad

Comparing Wong Engineering Corporation Berhad's CEO Compensation With the industry

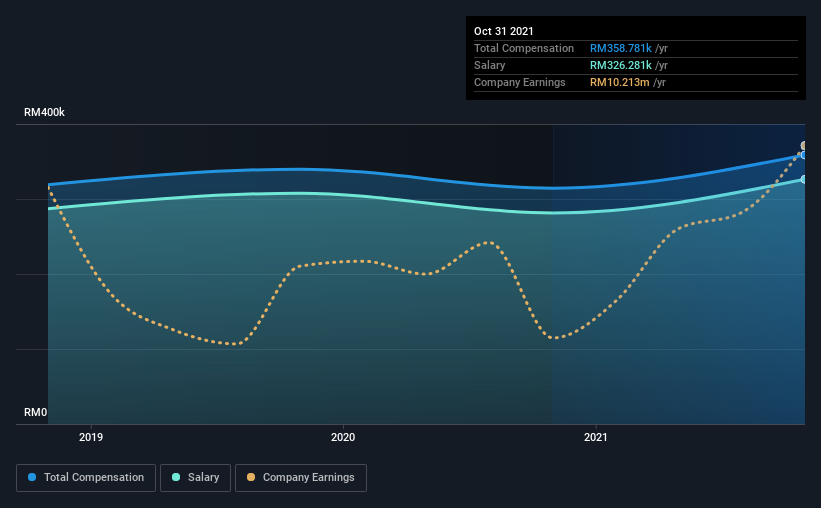

At the time of writing, our data shows that Wong Engineering Corporation Berhad has a market capitalization of RM143m, and reported total annual CEO compensation of RM359k for the year to October 2021. We note that's an increase of 14% above last year. In particular, the salary of RM326.3k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under RM840m, the reported median total CEO compensation was RM321k. This suggests that Wong Engineering Corporation Berhad remunerates its CEO largely in line with the industry average. Furthermore, Loy Yong directly owns RM28m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | RM326k | RM281k | 91% |

| Other | RM33k | RM33k | 9% |

| Total Compensation | RM359k | RM314k | 100% |

Talking in terms of the industry, salary represented approximately 76% of total compensation out of all the companies we analyzed, while other remuneration made up 24% of the pie. It's interesting to note that Wong Engineering Corporation Berhad pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Wong Engineering Corporation Berhad's Growth Numbers

Wong Engineering Corporation Berhad's earnings per share (EPS) grew 7.0% per year over the last three years. It achieved revenue growth of 18% over the last year.

This revenue growth could really point to a brighter future. And the modest growth in EPS isn't bad, either. So while we'd stop just short of calling this a top performer, but we think it is well worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Wong Engineering Corporation Berhad Been A Good Investment?

We think that the total shareholder return of 142%, over three years, would leave most Wong Engineering Corporation Berhad shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 2 warning signs for Wong Engineering Corporation Berhad that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Wong Engineering Corporation Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:WONG

Wong Engineering Corporation Berhad

Designs, manufactures, and sells high precision stamped and turned metal parts, components, and welded frame structures in Malaysia, Asia, Europe, and internationally.

Low and slightly overvalued.

Market Insights

Community Narratives