- Malaysia

- /

- Industrials

- /

- KLSE:WARISAN

Warisan TC Holdings Berhad (KLSE:WARISAN) Could Be Riskier Than It Looks

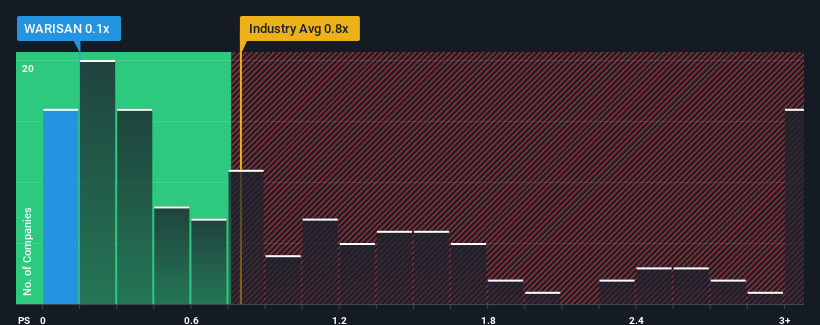

When close to half the companies operating in the Industrials industry in Malaysia have price-to-sales ratios (or "P/S") above 0.8x, you may consider Warisan TC Holdings Berhad (KLSE:WARISAN) as an attractive investment with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Warisan TC Holdings Berhad

What Does Warisan TC Holdings Berhad's Recent Performance Look Like?

Revenue has risen at a steady rate over the last year for Warisan TC Holdings Berhad, which is generally not a bad outcome. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Warisan TC Holdings Berhad's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Warisan TC Holdings Berhad?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Warisan TC Holdings Berhad's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 2.5%. Pleasingly, revenue has also lifted 33% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that to the industry, which is only predicted to deliver 1.9% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's peculiar that Warisan TC Holdings Berhad's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What Does Warisan TC Holdings Berhad's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We're very surprised to see Warisan TC Holdings Berhad currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

Before you take the next step, you should know about the 3 warning signs for Warisan TC Holdings Berhad (2 are a bit concerning!) that we have uncovered.

If these risks are making you reconsider your opinion on Warisan TC Holdings Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Warisan TC Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:WARISAN

Warisan TC Holdings Berhad

An investment holding company, offers travel and car rental, automotive, machinery, and consumer products and services.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives