- Malaysia

- /

- Construction

- /

- KLSE:VINVEST

Is Vinvest Capital Holdings Berhad (KLSE:VINVEST) Using Too Much Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Vinvest Capital Holdings Berhad (KLSE:VINVEST) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Vinvest Capital Holdings Berhad

How Much Debt Does Vinvest Capital Holdings Berhad Carry?

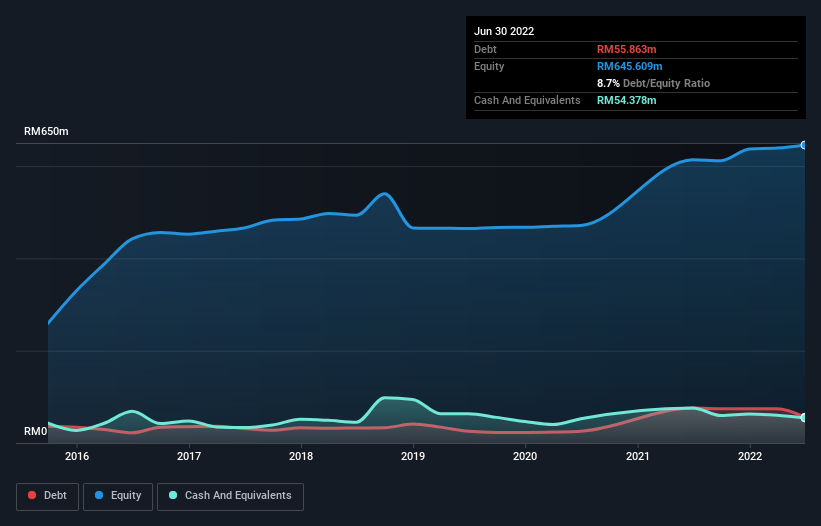

The image below, which you can click on for greater detail, shows that Vinvest Capital Holdings Berhad had debt of RM55.9m at the end of June 2022, a reduction from RM75.6m over a year. However, it also had RM54.4m in cash, and so its net debt is RM1.49m.

A Look At Vinvest Capital Holdings Berhad's Liabilities

The latest balance sheet data shows that Vinvest Capital Holdings Berhad had liabilities of RM112.4m due within a year, and liabilities of RM39.1m falling due after that. Offsetting these obligations, it had cash of RM54.4m as well as receivables valued at RM312.1m due within 12 months. So it actually has RM215.0m more liquid assets than total liabilities.

This luscious liquidity implies that Vinvest Capital Holdings Berhad's balance sheet is sturdy like a giant sequoia tree. With this in mind one could posit that its balance sheet means the company is able to handle some adversity. But either way, Vinvest Capital Holdings Berhad has virtually no net debt, so it's fair to say it does not have a heavy debt load!

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

With net debt at just 0.088 times EBITDA, it seems Vinvest Capital Holdings Berhad only uses a little bit of leverage. Although with EBIT only covering interest expenses 3.0 times over, the company is truly paying for borrowing. It is well worth noting that Vinvest Capital Holdings Berhad's EBIT shot up like bamboo after rain, gaining 33% in the last twelve months. That'll make it easier to manage its debt. There's no doubt that we learn most about debt from the balance sheet. But it is Vinvest Capital Holdings Berhad's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Vinvest Capital Holdings Berhad recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

Vinvest Capital Holdings Berhad's EBIT growth rate suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But the stark truth is that we are concerned by its conversion of EBIT to free cash flow. Looking at the bigger picture, we think Vinvest Capital Holdings Berhad's use of debt seems quite reasonable and we're not concerned about it. After all, sensible leverage can boost returns on equity. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Vinvest Capital Holdings Berhad that you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you're looking to trade Vinvest Capital Holdings Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:VINVEST

Vinvest Capital Holdings Berhad

An investment holding company, provides construction, property development, aluminium design and fabrication, and telecommunication engineering services in Malaysia.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives