- Malaysia

- /

- Trade Distributors

- /

- KLSE:TURBO

Should You Be Adding Turbo-Mech Berhad (KLSE:TURBO) To Your Watchlist Today?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Turbo-Mech Berhad (KLSE:TURBO). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Turbo-Mech Berhad

Turbo-Mech Berhad's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. It certainly is nice to see that Turbo-Mech Berhad has managed to grow EPS by 20% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

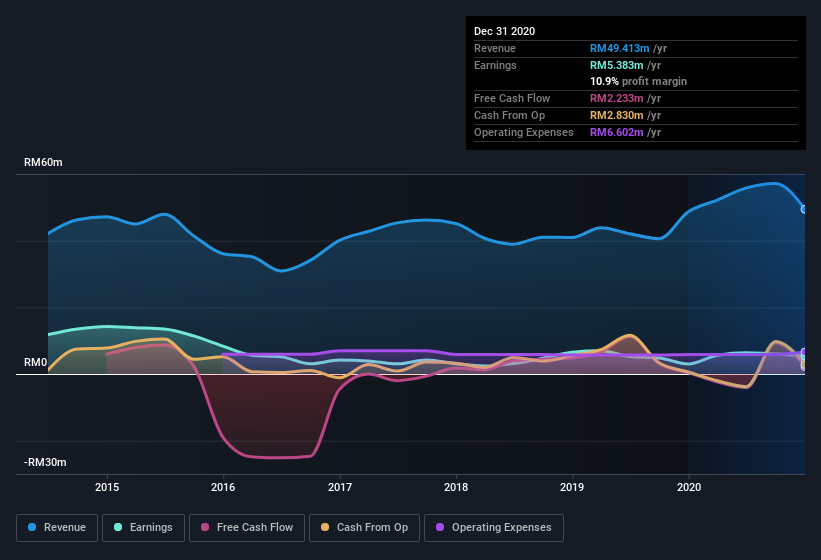

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. This approach makes Turbo-Mech Berhad look pretty good, on balance; although revenue is flattish, EBIT margins improved from 4.5% to 10% in the last year. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Turbo-Mech Berhad is no giant, with a market capitalization of RM92m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Turbo-Mech Berhad Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So we're pleased to report that Turbo-Mech Berhad insiders own a meaningful share of the business. In fact, they own 54% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. Of course, Turbo-Mech Berhad is a very small company, with a market cap of only RM92m. So despite a large proportional holding, insiders only have RM49m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. For companies with market capitalizations under RM825m, like Turbo-Mech Berhad, the median CEO pay is around RM575k.

The CEO of Turbo-Mech Berhad was paid just RM22k in total compensation for the year ending . You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Turbo-Mech Berhad To Your Watchlist?

You can't deny that Turbo-Mech Berhad has grown its earnings per share at a very impressive rate. That's attractive. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. This may only be a fast rundown, but the takeaway for me is that Turbo-Mech Berhad is worth keeping an eye on. Still, you should learn about the 3 warning signs we've spotted with Turbo-Mech Berhad .

Although Turbo-Mech Berhad certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Turbo-Mech Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:TURBO

Turbo-Mech Berhad

An investment holding company, sells rotating equipment and spare parts for the oil and gas, petrochemical, and chemical industries in Malaysia, Singapore, Indonesia, the Philippines, Thailand, Vietnam, Brunei, and internationally.

Flawless balance sheet slight.

Market Insights

Community Narratives