- Malaysia

- /

- Construction

- /

- KLSE:SENDAI

Improved Revenues Required Before Eversendai Corporation Berhad (KLSE:SENDAI) Stock's 25% Jump Looks Justified

Despite an already strong run, Eversendai Corporation Berhad (KLSE:SENDAI) shares have been powering on, with a gain of 25% in the last thirty days. The last month tops off a massive increase of 289% in the last year.

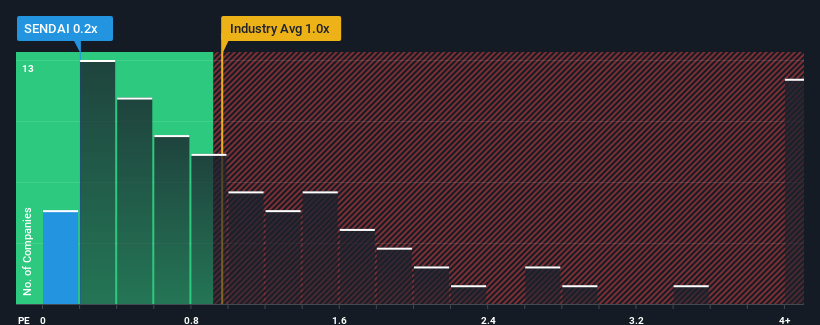

In spite of the firm bounce in price, when close to half the companies operating in Malaysia's Construction industry have price-to-sales ratios (or "P/S") above 1x, you may still consider Eversendai Corporation Berhad as an enticing stock to check out with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Eversendai Corporation Berhad

How Has Eversendai Corporation Berhad Performed Recently?

With revenue growth that's exceedingly strong of late, Eversendai Corporation Berhad has been doing very well. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Eversendai Corporation Berhad will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Eversendai Corporation Berhad would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 61% last year. Pleasingly, revenue has also lifted 31% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 12% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in consideration, it's easy to understand why Eversendai Corporation Berhad's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What Does Eversendai Corporation Berhad's P/S Mean For Investors?

Despite Eversendai Corporation Berhad's share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

In line with expectations, Eversendai Corporation Berhad maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Plus, you should also learn about these 3 warning signs we've spotted with Eversendai Corporation Berhad (including 2 which are concerning).

If you're unsure about the strength of Eversendai Corporation Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Eversendai Corporation Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SENDAI

Eversendai Corporation Berhad

Provides construction services in the Middle East, India, Southeast Asia, and internationally.

Acceptable track record with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.