Investors Continue Waiting On Sidelines For Sealink International Berhad (KLSE:SEALINK)

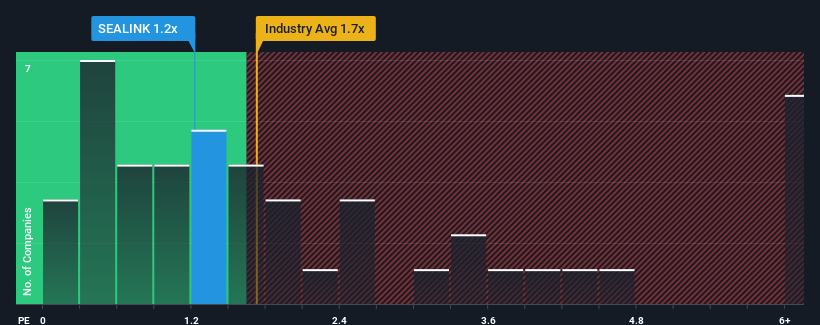

With a median price-to-sales (or "P/S") ratio of close to 1.7x in the Machinery industry in Malaysia, you could be forgiven for feeling indifferent about Sealink International Berhad's (KLSE:SEALINK) P/S ratio of 1.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Sealink International Berhad

What Does Sealink International Berhad's Recent Performance Look Like?

Sealink International Berhad certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Sealink International Berhad, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Sealink International Berhad would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 30% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 276% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 24% shows it's noticeably more attractive.

With this information, we find it interesting that Sealink International Berhad is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We didn't quite envision Sealink International Berhad's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It is also worth noting that we have found 2 warning signs for Sealink International Berhad that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SEALINK

Sealink International Berhad

An investment holding company, owns, builds, and operates a fleet of offshore marine support vessels in Malaysia, Singapore, and Vietnam.

Flawless balance sheet and good value.

Market Insights

Community Narratives