- Malaysia

- /

- Electrical

- /

- KLSE:SCABLE

Sarawak Cable Berhad (KLSE:SCABLE) Not Doing Enough For Some Investors As Its Shares Slump 32%

Sarawak Cable Berhad (KLSE:SCABLE) shareholders that were waiting for something to happen have been dealt a blow with a 32% share price drop in the last month. Still, a bad month hasn't completely ruined the past year with the stock gaining 40%, which is great even in a bull market.

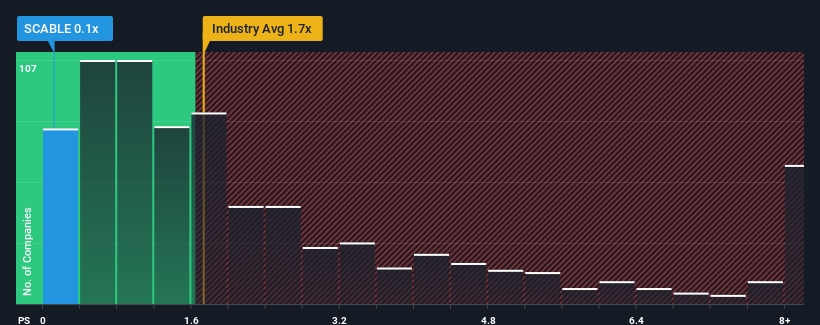

Following the heavy fall in price, considering around half the companies operating in Malaysia's Electrical industry have price-to-sales ratios (or "P/S") above 1.8x, you may consider Sarawak Cable Berhad as an solid investment opportunity with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Sarawak Cable Berhad

What Does Sarawak Cable Berhad's Recent Performance Look Like?

For instance, Sarawak Cable Berhad's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Sarawak Cable Berhad will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sarawak Cable Berhad's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Sarawak Cable Berhad?

The only time you'd be truly comfortable seeing a P/S as low as Sarawak Cable Berhad's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 34%. This means it has also seen a slide in revenue over the longer-term as revenue is down 38% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 32% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's understandable that Sarawak Cable Berhad's P/S would sit below the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Final Word

Sarawak Cable Berhad's recently weak share price has pulled its P/S back below other Electrical companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Sarawak Cable Berhad revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Sarawak Cable Berhad (3 don't sit too well with us!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Sarawak Cable Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:SCABLE

Sarawak Cable Berhad

Manufactures and sells power cables, wires, and conductors in Malaysia and internationally.

Moderate and slightly overvalued.

Market Insights

Community Narratives