- Malaysia

- /

- Trade Distributors

- /

- KLSE:PTT

PTT Synergy Group Berhad's (KLSE:PTT) Promising Earnings May Rest On Soft Foundations

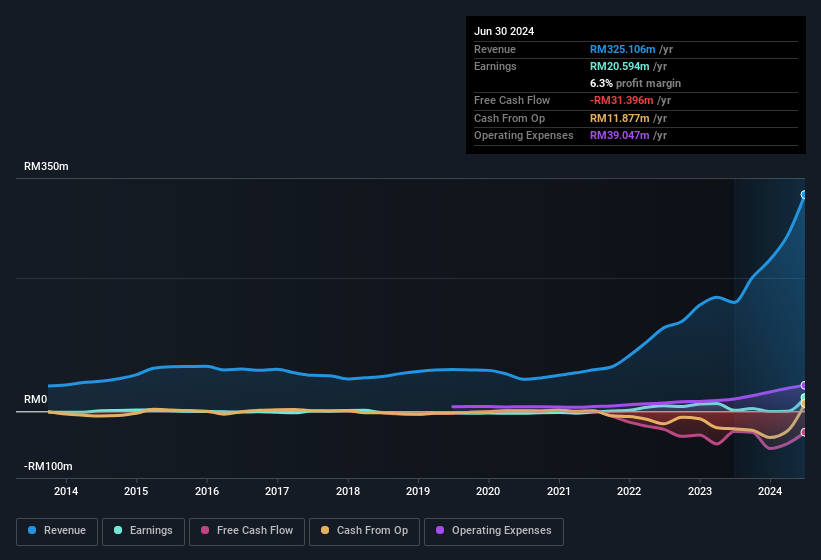

PTT Synergy Group Berhad's (KLSE:PTT) robust earnings report didn't manage to move the market for its stock. Our analysis suggests that this might be because shareholders have noticed some concerning underlying factors.

View our latest analysis for PTT Synergy Group Berhad

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, PTT Synergy Group Berhad issued 20% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of PTT Synergy Group Berhad's EPS by clicking here.

A Look At The Impact Of PTT Synergy Group Berhad's Dilution On Its Earnings Per Share (EPS)

PTT Synergy Group Berhad was losing money three years ago. The good news is that profit was up 1,193% in the last twelve months. But EPS was less impressive, up only 595% in that time. And so, you can see quite clearly that dilution is influencing shareholder earnings.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So it will certainly be a positive for shareholders if PTT Synergy Group Berhad can grow EPS persistently. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of PTT Synergy Group Berhad.

Our Take On PTT Synergy Group Berhad's Profit Performance

Each PTT Synergy Group Berhad share now gets a meaningfully smaller slice of its overall profit, due to dilution of existing shareholders. Because of this, we think that it may be that PTT Synergy Group Berhad's statutory profits are better than its underlying earnings power. But the happy news is that, while acknowledging we have to look beyond the statutory numbers, those numbers are still improving, with EPS growing at a very high rate over the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So while earnings quality is important, it's equally important to consider the risks facing PTT Synergy Group Berhad at this point in time. To help with this, we've discovered 2 warning signs (1 doesn't sit too well with us!) that you ought to be aware of before buying any shares in PTT Synergy Group Berhad.

This note has only looked at a single factor that sheds light on the nature of PTT Synergy Group Berhad's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

If you're looking to trade PTT Synergy Group Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PTT

PTT Synergy Group Berhad

An investment holding company, engages in the trading and supply of hardware and related products in Malaysia.

Reasonable growth potential low.

Market Insights

Community Narratives