- Malaysia

- /

- Construction

- /

- KLSE:PRTASCO

Protasco Berhad (KLSE:PRTASCO) Surges 28% Yet Its Low P/S Is No Reason For Excitement

Despite an already strong run, Protasco Berhad (KLSE:PRTASCO) shares have been powering on, with a gain of 28% in the last thirty days. The last month tops off a massive increase of 116% in the last year.

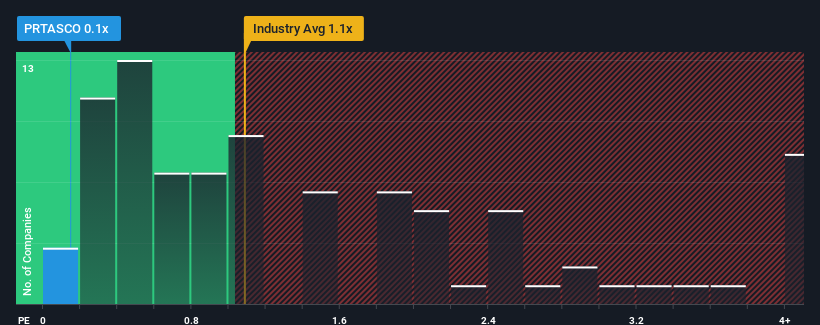

Even after such a large jump in price, when close to half the companies operating in Malaysia's Construction industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider Protasco Berhad as an enticing stock to check out with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Protasco Berhad

What Does Protasco Berhad's P/S Mean For Shareholders?

Revenue has risen firmly for Protasco Berhad recently, which is pleasing to see. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Protasco Berhad will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Protasco Berhad will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Protasco Berhad?

The only time you'd be truly comfortable seeing a P/S as low as Protasco Berhad's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 27%. As a result, it also grew revenue by 5.9% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 14% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in consideration, it's easy to understand why Protasco Berhad's P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

What Does Protasco Berhad's P/S Mean For Investors?

Protasco Berhad's stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Protasco Berhad confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Protasco Berhad has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:PRTASCO

Protasco Berhad

An investment holding company, provides infrastructure solutions in Malaysia.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.