- Malaysia

- /

- Construction

- /

- KLSE:PRTASCO

Protasco Berhad (KLSE:PRTASCO) Shares Fly 35% But Investors Aren't Buying For Growth

Protasco Berhad (KLSE:PRTASCO) shareholders would be excited to see that the share price has had a great month, posting a 35% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 77% in the last year.

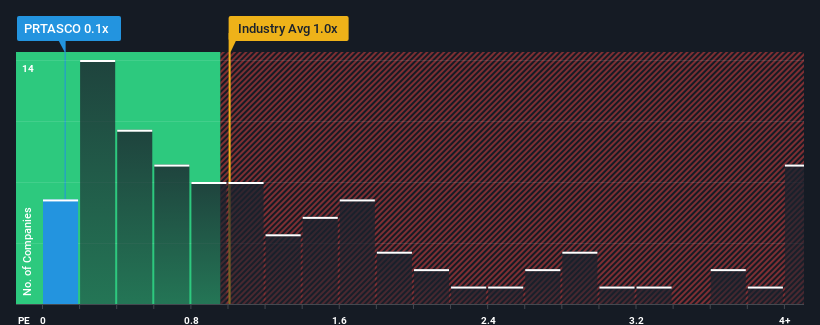

In spite of the firm bounce in price, it would still be understandable if you think Protasco Berhad is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in Malaysia's Construction industry have P/S ratios above 1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Protasco Berhad

What Does Protasco Berhad's Recent Performance Look Like?

Revenue has risen firmly for Protasco Berhad recently, which is pleasing to see. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. Those who are bullish on Protasco Berhad will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Protasco Berhad will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Protasco Berhad's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. The latest three year period has also seen a 26% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 21% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Protasco Berhad is trading at a P/S lower than the industry. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On Protasco Berhad's P/S

Protasco Berhad's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Protasco Berhad confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Protasco Berhad (of which 1 is potentially serious!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PRTASCO

Protasco Berhad

An investment holding company, provides infrastructure solutions in Malaysia.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives