- Malaysia

- /

- Electrical

- /

- KLSE:PIE

P.I.E. Industrial Berhad (KLSE:PIE) Stocks Pounded By 26% But Not Lagging Market On Growth Or Pricing

P.I.E. Industrial Berhad (KLSE:PIE) shares have had a horrible month, losing 26% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 40% in the last year.

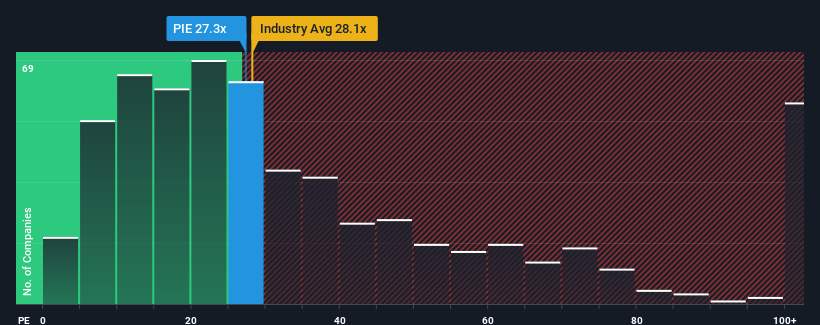

Even after such a large drop in price, P.I.E. Industrial Berhad may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 27.3x, since almost half of all companies in Malaysia have P/E ratios under 14x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

P.I.E. Industrial Berhad could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for P.I.E. Industrial Berhad

Is There Enough Growth For P.I.E. Industrial Berhad?

The only time you'd be truly comfortable seeing a P/E as steep as P.I.E. Industrial Berhad's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 13%. As a result, earnings from three years ago have also fallen 14% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 50% over the next year. With the market only predicted to deliver 17%, the company is positioned for a stronger earnings result.

In light of this, it's understandable that P.I.E. Industrial Berhad's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On P.I.E. Industrial Berhad's P/E

P.I.E. Industrial Berhad's shares may have retreated, but its P/E is still flying high. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of P.I.E. Industrial Berhad's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for P.I.E. Industrial Berhad with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of P.I.E. Industrial Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PIE

P.I.E. Industrial Berhad

An investment holding company, manufactures and sells industrial products in Malaysia, other Asia Pacific countries, the United States, Europe, and Africa.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives