- Malaysia

- /

- Trade Distributors

- /

- KLSE:PASUKGB

After Leaping 42% Pasukhas Group Berhad (KLSE:PASUKGB) Shares Are Not Flying Under The Radar

Pasukhas Group Berhad (KLSE:PASUKGB) shares have had a really impressive month, gaining 42% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 45% over that time.

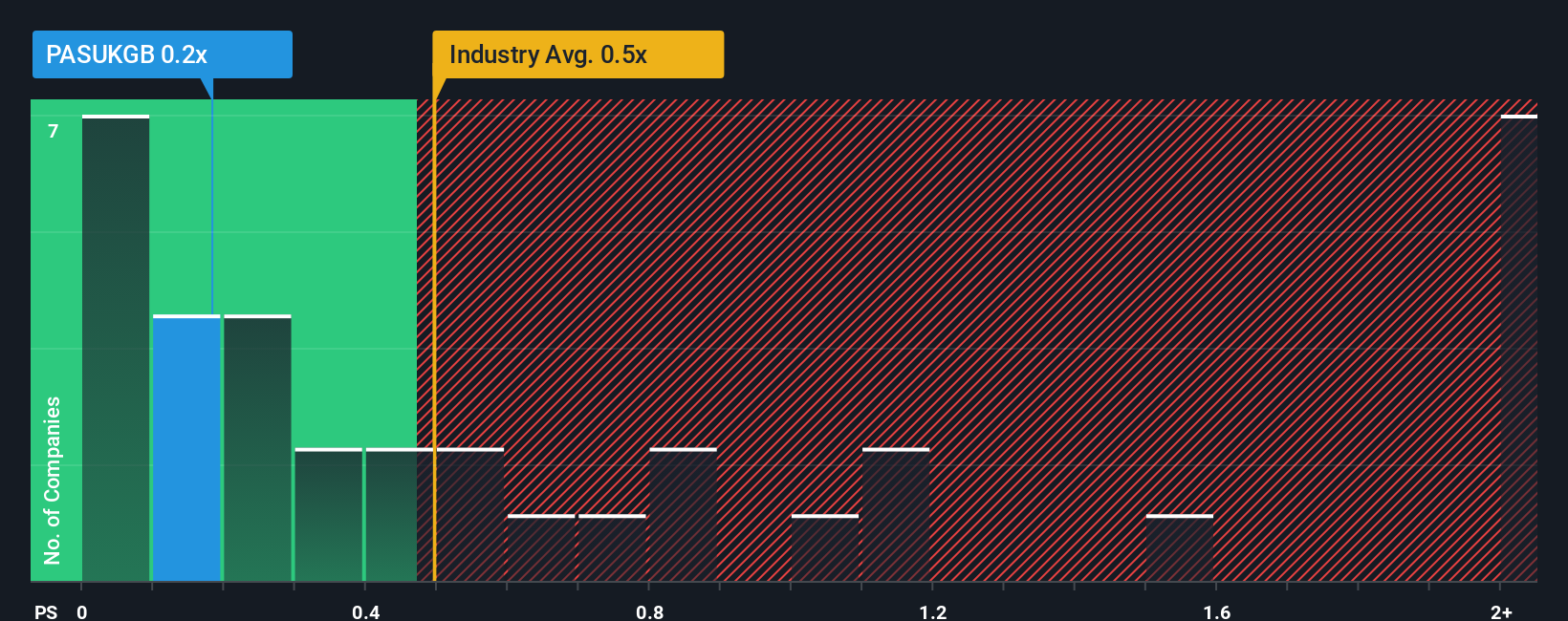

Although its price has surged higher, there still wouldn't be many who think Pasukhas Group Berhad's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in Malaysia's Trade Distributors industry is similar at about 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Pasukhas Group Berhad

How Has Pasukhas Group Berhad Performed Recently?

The revenue growth achieved at Pasukhas Group Berhad over the last year would be more than acceptable for most companies. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Pasukhas Group Berhad's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Pasukhas Group Berhad's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 19% last year. As a result, it also grew revenue by 18% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 5.0% shows it's about the same on an annualised basis.

With this information, we can see why Pasukhas Group Berhad is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Final Word

Pasukhas Group Berhad's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It appears to us that Pasukhas Group Berhad maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Pasukhas Group Berhad, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Pasukhas Group Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PASUKGB

Pasukhas Group Berhad

An investment holding company, operates as a civil, mechanical, and electrical company serving various market segments in Malaysia.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives