- Malaysia

- /

- Construction

- /

- KLSE:NADIBHD

These 4 Measures Indicate That Gagasan Nadi Cergas Berhad (KLSE:NADIBHD) Is Using Debt Extensively

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Gagasan Nadi Cergas Berhad (KLSE:NADIBHD) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Gagasan Nadi Cergas Berhad

How Much Debt Does Gagasan Nadi Cergas Berhad Carry?

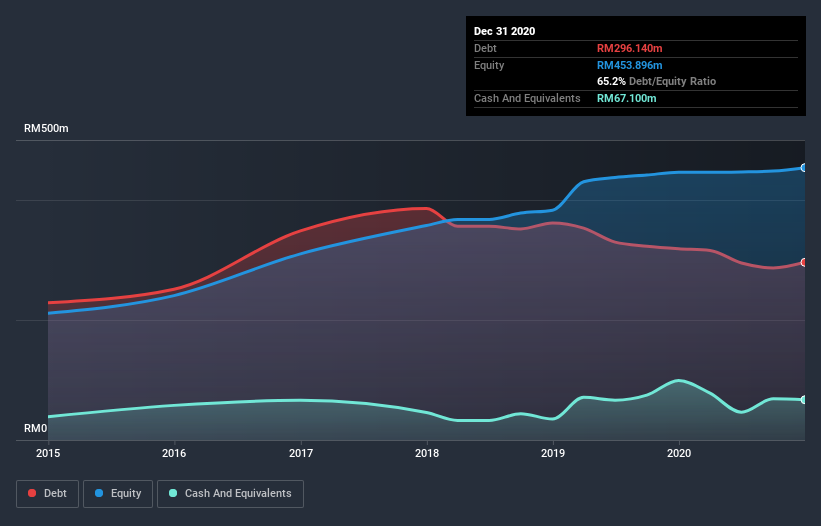

You can click the graphic below for the historical numbers, but it shows that Gagasan Nadi Cergas Berhad had RM296.1m of debt in December 2020, down from RM318.8m, one year before. On the flip side, it has RM67.1m in cash leading to net debt of about RM229.0m.

A Look At Gagasan Nadi Cergas Berhad's Liabilities

The latest balance sheet data shows that Gagasan Nadi Cergas Berhad had liabilities of RM112.2m due within a year, and liabilities of RM339.8m falling due after that. Offsetting this, it had RM67.1m in cash and RM119.7m in receivables that were due within 12 months. So it has liabilities totalling RM265.2m more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's RM233.4m market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Gagasan Nadi Cergas Berhad shareholders face the double whammy of a high net debt to EBITDA ratio (6.8), and fairly weak interest coverage, since EBIT is just 2.0 times the interest expense. This means we'd consider it to have a heavy debt load. The good news is that Gagasan Nadi Cergas Berhad grew its EBIT a smooth 30% over the last twelve months. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Gagasan Nadi Cergas Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Gagasan Nadi Cergas Berhad actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

We feel some trepidation about Gagasan Nadi Cergas Berhad's difficulty net debt to EBITDA, but we've got positives to focus on, too. For example, its conversion of EBIT to free cash flow and EBIT growth rate give us some confidence in its ability to manage its debt. Looking at all the angles mentioned above, it does seem to us that Gagasan Nadi Cergas Berhad is a somewhat risky investment as a result of its debt. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 5 warning signs with Gagasan Nadi Cergas Berhad (at least 2 which shouldn't be ignored) , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Gagasan Nadi Cergas Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:NADIBHD

Gagasan Nadi Cergas Berhad

An investment holding company, engages in the development of residential, commercial, and industrial property in Malaysia.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives