- Malaysia

- /

- Industrials

- /

- KLSE:MUIIND

Malayan United Industries Berhad (KLSE:MUIIND) shareholders are up 15% this past week, but still in the red over the last five years

Malayan United Industries Berhad (KLSE:MUIIND) shareholders should be happy to see the share price up 15% in the last week. But that doesn't change the fact that the returns over the last half decade have been disappointing. In fact, the share price has declined rather badly, down some 63% in that time. So is the recent increase sufficient to restore confidence in the stock? Not yet. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

On a more encouraging note the company has added RM32m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

See our latest analysis for Malayan United Industries Berhad

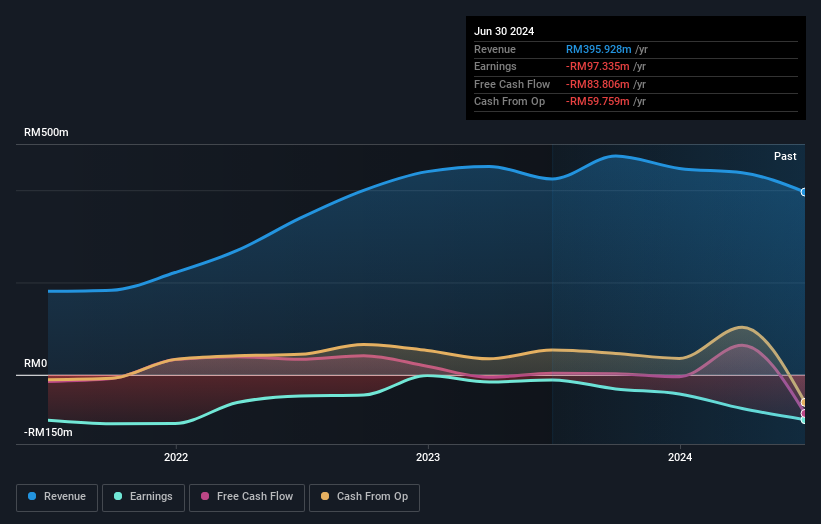

Given that Malayan United Industries Berhad didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over five years, Malayan United Industries Berhad grew its revenue at 8.7% per year. That's a fairly respectable growth rate. The share price, meanwhile, has fallen 10% compounded, over five years. It seems probably that the business has failed to live up to initial expectations. That could lead to an opportunity if the company is going to become profitable sooner rather than later.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's nice to see that Malayan United Industries Berhad shareholders have received a total shareholder return of 25% over the last year. There's no doubt those recent returns are much better than the TSR loss of 10% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Malayan United Industries Berhad better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Malayan United Industries Berhad (including 1 which is significant) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MUIIND

Malayan United Industries Berhad

An investment holding company, primarily engages in the retailing, hotel, property, food, fast food chain, and financial service businesses in Malaysia, the Asia-Pacific, Australia, North America, and the United Kingdom.

Low and slightly overvalued.

Market Insights

Community Narratives