MMS Ventures Berhad (KLSE:MMSV) Will Pay A Dividend Of RM0.01

MMS Ventures Berhad (KLSE:MMSV) will pay a dividend of RM0.01 on the 15th of October. This means that the annual payment will be 1.1% of the current stock price, which is in line with the average for the industry.

View our latest analysis for MMS Ventures Berhad

MMS Ventures Berhad's Dividend Is Well Covered By Earnings

Unless the payments are sustainable, the dividend yield doesn't mean too much. The last payment was quite easily covered by earnings, but it made up 132% of cash flows. This signals that the company is more focused on returning cash flow to shareholders, but it could mean that the dividend is exposed to cuts in the future.

EPS is set to fall by 10.0% over the next 12 months if recent trends continue. Assuming the dividend continues along recent trends, we believe the payout ratio could be 46%, which we are pretty comfortable with and we think is feasible on an earnings basis.

MMS Ventures Berhad's Dividend Has Lacked Consistency

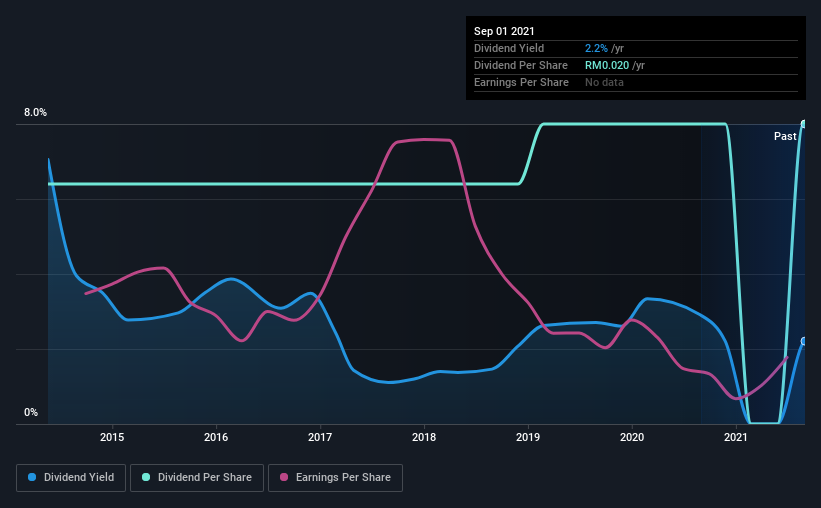

MMS Ventures Berhad has been paying dividends for a while, but the track record isn't stellar. This suggests that the dividend might not be the most reliable. Since 2014, the dividend has gone from RM0.016 to RM0.02. This implies that the company grew its distributions at a yearly rate of about 3.2% over that duration. The dividend has seen some fluctuations in the past, so even though the dividend was raised this year, we should remember that it has been cut in the past.

Dividend Growth Is Doubtful

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Over the past five years, it looks as though MMS Ventures Berhad's EPS has declined at around 10.0% a year. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed.

MMS Ventures Berhad's Dividend Doesn't Look Sustainable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We don't think MMS Ventures Berhad is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. For example, we've identified 5 warning signs for MMS Ventures Berhad (1 can't be ignored!) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:MMSV

MMS Ventures Berhad

An investment holding company, provides automation solutions for LED, semiconductor, and the OEM/ODM markets in Malaysia, rest of Asia, the United States, Europe, and Australia.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives