- Malaysia

- /

- Trade Distributors

- /

- KLSE:LUXCHEM

Should You Be Adding Luxchem Corporation Berhad (KLSE:LUXCHEM) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like Luxchem Corporation Berhad (KLSE:LUXCHEM). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Luxchem Corporation Berhad

Luxchem Corporation Berhad's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. We can see that in the last three years Luxchem Corporation Berhad grew its EPS by 14% per year. That's a pretty good rate, if the company can sustain it.

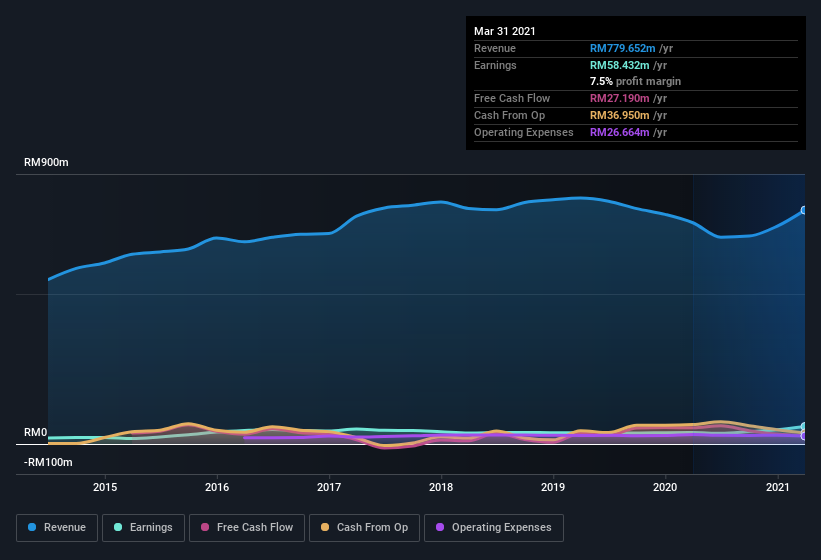

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Luxchem Corporation Berhad shareholders can take confidence from the fact that EBIT margins are up from 7.4% to 10%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Luxchem Corporation Berhad is no giant, with a market capitalization of RM937m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Luxchem Corporation Berhad Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. As a result, I'm encouraged by the fact that insiders own Luxchem Corporation Berhad shares worth a considerable sum. Given insiders own a small fortune of shares, currently valued at RM222m, they have plenty of motivation to push the business to succeed. At 24% of the company, the co-investment by insiders gives me confidence that management will make long-term focussed decisions.

Should You Add Luxchem Corporation Berhad To Your Watchlist?

One important encouraging feature of Luxchem Corporation Berhad is that it is growing profits. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. You still need to take note of risks, for example - Luxchem Corporation Berhad has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Although Luxchem Corporation Berhad certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:LUXCHEM

Luxchem Corporation Berhad

An investment holding company, imports, exports, and distributes petrochemical and other related products in Malaysia and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives