- Malaysia

- /

- Trade Distributors

- /

- KLSE:KPSCB

Does KPS Consortium Berhad (KLSE:KPSCB) Have A Healthy Balance Sheet?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies KPS Consortium Berhad (KLSE:KPSCB) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for KPS Consortium Berhad

What Is KPS Consortium Berhad's Net Debt?

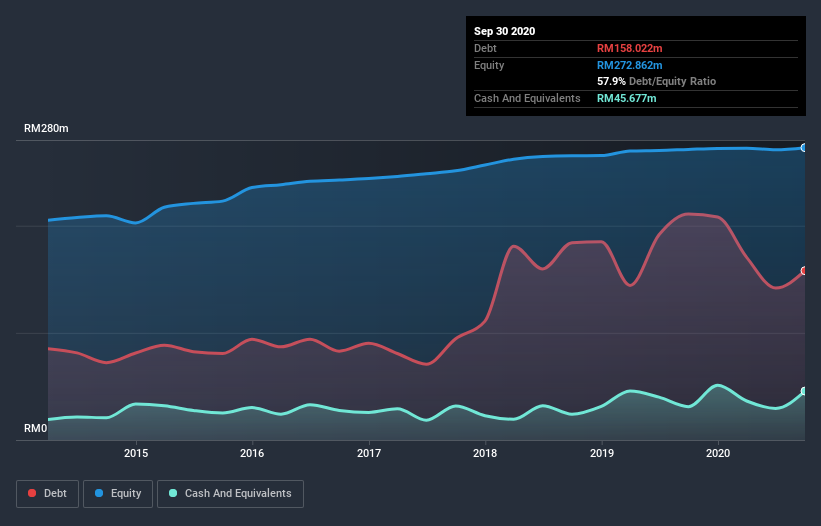

The image below, which you can click on for greater detail, shows that KPS Consortium Berhad had debt of RM158.0m at the end of September 2020, a reduction from RM211.0m over a year. However, it does have RM45.7m in cash offsetting this, leading to net debt of about RM112.3m.

How Strong Is KPS Consortium Berhad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that KPS Consortium Berhad had liabilities of RM206.8m due within 12 months and liabilities of RM33.0m due beyond that. Offsetting this, it had RM45.7m in cash and RM202.4m in receivables that were due within 12 months. So it actually has RM8.37m more liquid assets than total liabilities.

This surplus suggests that KPS Consortium Berhad has a conservative balance sheet, and could probably eliminate its debt without much difficulty.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Weak interest cover of 0.97 times and a disturbingly high net debt to EBITDA ratio of 12.2 hit our confidence in KPS Consortium Berhad like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. Even worse, KPS Consortium Berhad saw its EBIT tank 74% over the last 12 months. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. There's no doubt that we learn most about debt from the balance sheet. But it is KPS Consortium Berhad's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the most recent three years, KPS Consortium Berhad recorded free cash flow worth 52% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Both KPS Consortium Berhad's EBIT growth rate and its interest cover were discouraging. At least its level of total liabilities gives us reason to be optimistic. When we consider all the factors discussed, it seems to us that KPS Consortium Berhad is taking some risks with its use of debt. While that debt can boost returns, we think the company has enough leverage now. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 5 warning signs for KPS Consortium Berhad (2 are potentially serious!) that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade KPS Consortium Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade KPS Consortium Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if KPS Consortium Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:KPSCB

KPS Consortium Berhad

An investment holding company, engages in the distribution and retail of wooden doors, plywood, and related building materials primarily in Malaysia.

Excellent balance sheet and good value.

Market Insights

Community Narratives